The entire corpus of pension money under the National Pension Scheme (NPS) that can be withdrawn by individuals at the time of retirement will now be tax exempt, the government said on Monday .

The NPS allows subscribers to withdraw 60 per cent of their pension kitty at the time of retirement, with the remaining invested in annuities.

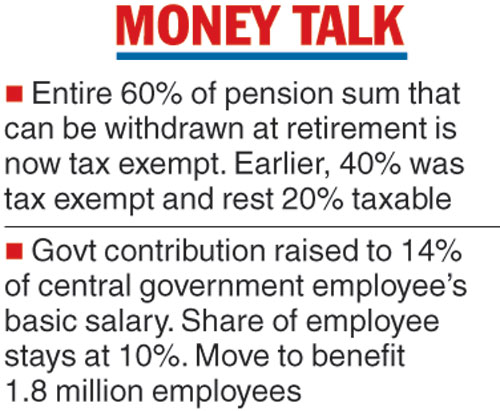

Earlier 40 per cent of the total sum was tax exempt and the rest 20 per cent was taxable, but now the entire 60 per cent is tax exempt.

The withdrawable portion is now EEE (exempt, exempt, exempt), which means it is not taxed by the government when contributed, not taxed while the contribution is earning interest and not taxed when finally withdrawn.

Last week, the Union cabinet had decided to raise the share of government in pension to 14 per cent of the central government employees’ basic salary. The employees’ contribution has, however, been maintained at 10 per cent of basic salary.

The government also said it would pay compensation for non-deposit or delayed deposit of NPS contributions during 2004-2012.

Besides, employees making extra contribution towards NPS, over and above the mandatory contribution that is called the Tier-II scheme, can enjoy tax deduction on their contribution up to Rs 1.50 lakh, on par with the provident funds schemes.

Eye on votes

Jaitley said changes have been made in NPS in “larger interest of employees”. However, they are seen as a bid to pacify central government employees who are an important vote base, especially in the National Capital Region as well as in railway townships across the country.

NPS also impacts central PSUs such as banks and the LIC which have opted for the scheme.

Some 1.8 million of the central government’s 4.84 million employees who joined after January 1, 2004 are covered by NPS, a defined pension scheme.

Officials said the impact on the exchequer on account of the increased pension contribution by the government is estimated to be around Rs. 2,840 crore for the financial year 2019-20, and will be in the nature of a recurring expenditure.