The Telegraph

The Prashant-Basant faction, which claims to have a little over a 25 per cent stake, has welcomed the Tatas as the buyer but raised doubts over the utilisation of the sale proceeds, especially if the same is used to pay off debt.

They have been demanding that the residual business — the wire and wire rope division — should also be sold to the Tatas and the money paid to all the shareholders.

If they vote against the deal, the special resolution will be defeated as it requires three yes votes for every no vote to pass a special resolution.

Prashant is at loggerheads with cousin Rajeev Jhawar, the managing director of UML, and fighting a legal battle at the National Company Law Tribunal. The sale process is, however, being carried out by the independent directors on the board of the company.

The deal will have a long stop date on September 21, 2019, a year from the signing of the definitive agreement. It can be extended for another three months.

This has been done to keep in mind that the transfer of coal and iron ore mines will be a long process.

UML will also be required to pay a break fee of Rs 500 crore if it fails to meet the conditions such as mine transfer.

Tata Steel will have the right of first refusal (RoFR) on the sale of the steel business of Usha Martin Ltd (UML) amid continued resistance from a promoter faction against the proposed transaction.

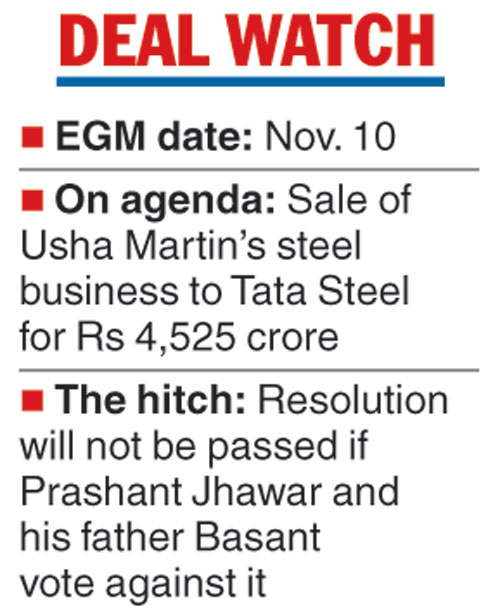

Usha Martin has called for an extraordinary general meeting on November 10 to sell the steel business, along with a iron ore and coal mine, to the Tatas for Rs 4,525 crore. The special resolution will not be passed if Prashant Jhawar and his father Basant vote against it.

According to the terms of the agreement between Tata Steel and UML, the purchaser will first have a 30-day right to require the seller to again seek the approval of shareholders if it fails to get the nod in the first attempt on November 10.

The Tatas will have the RoFR of one year from the date of such non-approval if Usha Martin plans to sell the steel business undertaking to some other companies/persons.

“This will protect the buyer in case a section of shareholders try to stonewall the deal. The seller also gets protection if it discovers higher price for the business from other buyers, as the Tatas would have to match it to exercise RoFR,” said a source close to the development.