The girth of Air India’s Maharaja — the portly mascot of the 90-year-old airline — is about to swell. On Tuesday, the Tatas and Singapore International Airlines (SIA) announced plans to merge Vistara with Air India, the former state-owned airline that came into the Bombay House fold after it was privatised in January.

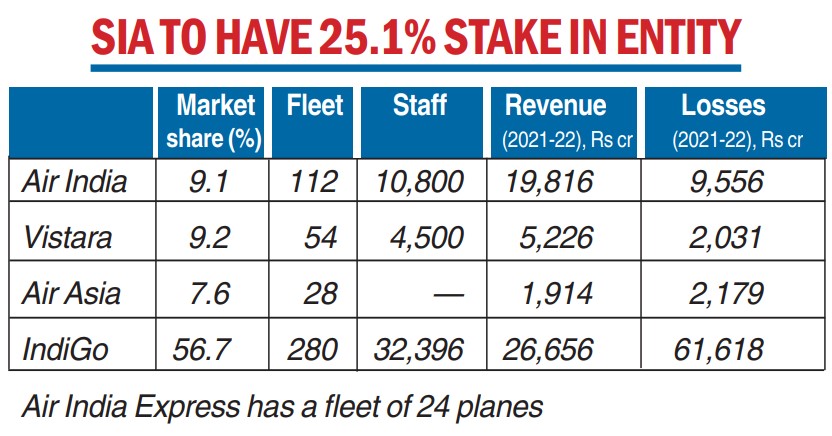

The combined entity will be India’s largest international carrier and second-largest domestic airline.

Singapore Airlines (SIA) which owns 49 per cent of Vistara will get a 25.1 per cent stake in the new Air India group. SIA announced it will be investing Rs 2,058.5 crore ($250 million) in Air India.

SIA and Tata have also agreed to participate in additional capital injection to fund the growth and operations of the merged Air India in 2022-23 and the subsequent fiscal year.

The airline said it could infuse up to Rs 5,020 crore ($615 million) based on its 25.1 per cent stake into the merged entity.

The Tata group has four airlines under its fold: Air India, Air India Express, AirAsia India and Vistara. The $ 28 billion conglomerate had acquired Air India and Air India Express in January.

The Tatas have already started consolidating Air Asia India fully with Air India Express. It said full integration through merger or otherwise is expected to take around 12 months.

Observers said that after the merger is completed, the Tatas could make Air India Express a budget carrier servicing both domestic and international routes, whereas the enlarged Air India is likely to be a full-service airline.

Tata Group chairman N. Chandrasekaran said the merger was an important milestone in efforts to rebuild Air India into a “world-class airline”.

“Air India is focusing on growing both its network and fleet, revamping its customer proposition, enhancing safety, reliability, and on-time performance,” Chandrasekaran said.

SIA said the combination with Vistara would bring significant synergies. “Air India has valuable slots and air traffic rights at domestic and international airports that are not available to Vistara. With Vistara widely recognised as India’s leading full-service carrier, Air India will benefit from its operational capabilities, customer base, and strong focus on customer service and product excellence.’’

Air India CEO and MD Campbell Wilson is likely to head the merged entity as speculation grows on the role of Vistara CEO Vinod Kannan.

In an email written to Vistara employees, Kannan said the various airlines under the Tata group ownership will be merged and it will result in two entities — Air India and its 100 per cent owned subsidiary, Air India Express.

In a statement, Campbell said Vistara has achieved much over the last eight years. “The skills, people, systems and processes that have driven Vistara’s success will complement, strengthen and accelerate Air India’s transformation programme.”

Aviation consultancy and research firm CAPA said the domestic industry is heading towards duopoly. “The competitive dynamics in India are moving towards a two-pillar system around the Air India group and IndiGo. The two carriers combined are in due course expected to achieve a domestic market share of 75-80 per cent,” CAPA India said.

In the international market, the share of the combined Air India and Vistara is expected to grow from 37.8 per cent in the second quarter of the current fiscal to over 50 per cent.

“This will redraw market and consumer power in the international arena back to Indian carriers, which has historically been dominated by foreign airlines.”

The merger will give Tata a fleet of 218 aircraft, split between Boeing and Airbus, flying to a combined 38 international and 52 domestic destinations.

With inputs from Reuters