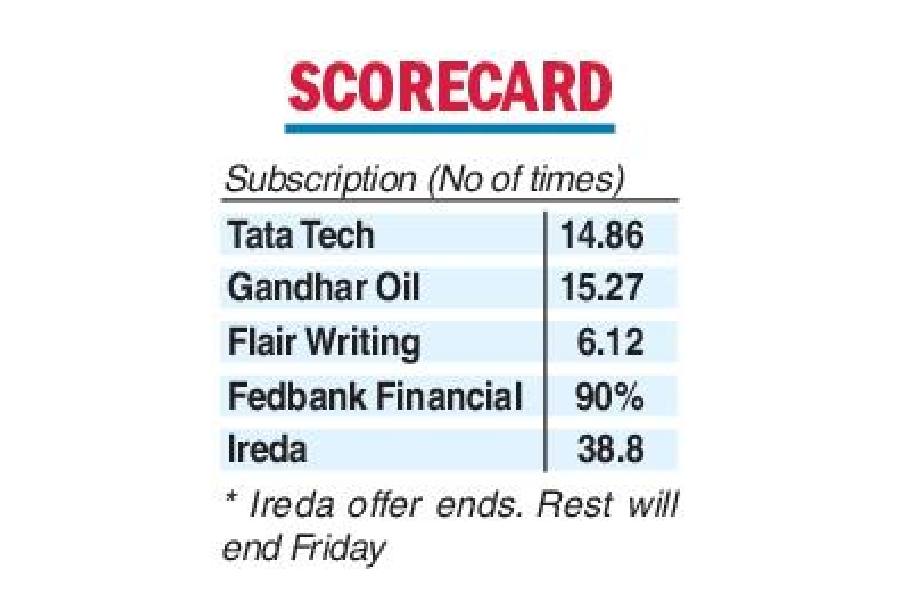

Investor appetite for Tata Technologies remained unabated on Thursday, with the first IPO from the Tata group in two decades getting subscribed 14.86 times on the second day.

Data from the BSE showed bids for 66.9 crore shares against 4.5 crore shares on offer worth Rs 3,042.5 crore

The portion set for non-institutional investors got subscribed 31.04 times, while the category for retail individual investors received 11.20 times subscription.

Market circles expect a big jump particularly in the QIB (qualified institutional buyers) portion when the issue closes for subscription on Friday.

TCS was the last company from the Tatas to make an initial public offer — way back in 2004. On Wednesday, the offering was fully subscribed in less than 40 minutes.

Earlier, Tata Technologies had garnered Rs 791 crore from anchor investors. The issue, which comes with a price band of Rs 475-500 per share will conclude on Friday.

Ireda float

The public issue from the state-owned Indian Renewable Energy Development Agency (Ireda) concluded on Thursday, with

subscription at 38.80 times. It received bids for 182.7 crore shares against 47.09 crore shares on offer.

Of this, the segment for Qualified Institutional Buyers (QIBs) was subscribed by a huge 104.57 times.

The quota for non-institutional investors was subscribed 24.16 times and the portion for RIIs received 7.73 times subscription.

Two other IPOs continued to do well: pen maker Flair Writing Industries witnessed its IPO being subscribed 6.12 times on day two.

The shares sale of Gandhar Oil Refinery (India) received 15.27 times subscription on the second day of the bidding.

Fedbank Financial Services was also heading towards full subscription with 90 per cent of the issue being subscribed.

Meanwhile, shares of Cipla plunged over 8 per cent on Thursday after the US health regulator pulled up the drug major for various manufacturing lapses at its Pithampur (Madhya Pradesh) based manufacturing facility.