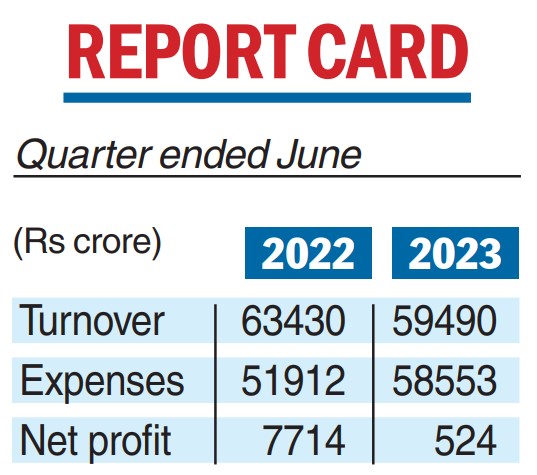

Tata Steel’s net profit slumped over 93 per cent on a consolidated basis to Rs 524.85 crore for the April-June quarter, following yet another weak performance of the European business. It had posted Rs 7,714 crore net profit in the corresponding period of 2022-23.

In contrast, the Indian operations posted a profit after tax of Rs 4,017 crore, even as it was down 30 per cent from the same period of the last fiscal.

The European business, spread over the UK and the Netherlands, recorded a negative EBIDTA of Rs 1,569 crore, compared with Rs 6,037 crore positive EBIDTA in Q1FY23.

Turnover of Tata Steel also declined to Rs 59,490 crore on a consolidated basis from Rs 63,430 crore in the year-ago quarter, a fall of 6.2 per cent. Expenses soared to Rs 58,553 crore from Rs 51,912 crore a year ago.

In a statement, Tata Steel said its net debt stands at Rs 71,397 crore and its liquidity remains strong at Rs 30,569 crore.

During the quarter, crude steel production was around 5 million tonnes (mt) , up 2 per cent year-on-year (y-o-y), primarily driven by a ramp up at Neelachal Ispat Nigam Limited.

Deliveries rose 18 per cent y-o-y to 4.8 mt, driven by a rise in domestic deliveries.

Tata Steel said it spent Rs 4,089 crore on capital expenditure during the quarter.

The company had earlier said it is planning a consolidated capital expenditure (capex) of Rs 16,000 crore for its domestic and global operations during FY2023-24.

In India, work on 5 mtpa expansion at Kalinganagar plant and EAF (electric arc furnace) mill of 0.75 mtpa in Punjab is progressing well.

The planned relining of BF6 (blast furnace) at Tata Steel Netherlands commenced in April and this has led to a drop in crude steel production. Liquid steel production was 1.79 mt while deliveries stood at 1.99 mt.

In the UK, the buy-in transaction for the residual liabilities of British Steel Pension Scheme has been completed, successfully derisking Tata Steel UK.

Tata Steel CEO & MD T.V. Narendran, who received the board’s approval for another five-year term at the helm, said during the quarter, globaleconomic recovery continued to face headwinds, affecting commodity prices, including steel.

In India, domestic steel demand continued to grow and was up around 10 percent y-o-y but steel spot prices moderated in line with global cues.

“We saw strong growth in key segments such as branded products and retail and industrial products and projects which grew by 37 per cent and 24 per cent, respectively, on a y-o-y basis.

“Our retail sales to individual home builders crossed 3mt in the last 12 months and we now serve 8,000+ out of 19,100 pin codes in India,” he said.

Koushik Chatterjee, executive director and chief financial officer, said consolidated EBITDA of the company stood at Rs 6,122 crore.