Tata Steel Ltd is seeking shareholders’ nod for related party transactions worth Rs 58,676 crore for FY24. The company has identified 14 entities, domestic and international, which will qualify under RPT as mandated by market watchdog Sebi’s listing regulations.

The largest pie of the transaction is intended for domestic subsidiaries such as NINL, Tata Steel Long Products Ltd, Tinplate Co Ltd and joint ventures in the downstream value chain. Taken together, the 14 transactions will account for about 24 per cent of Tata Steel’s consolidated turnover for FY22 (the company is yet to come out with consolidated numbers for FY23).

The resolutions highlight the complexity and size of Tata Steel’s India and international operations and underscore the basis for the company’s move to merge the listed subsidiaries with itself. The company had announced the merger of three listed subsidiaries, one listed associate company and two wholly owned unlisted companies with itself for enhancing the ease of doing business on September 22 last year.

It has received no objection/ no adverse comment from the bourses for the listed entities and filed applications before National Company Law Tribunals for the merger.

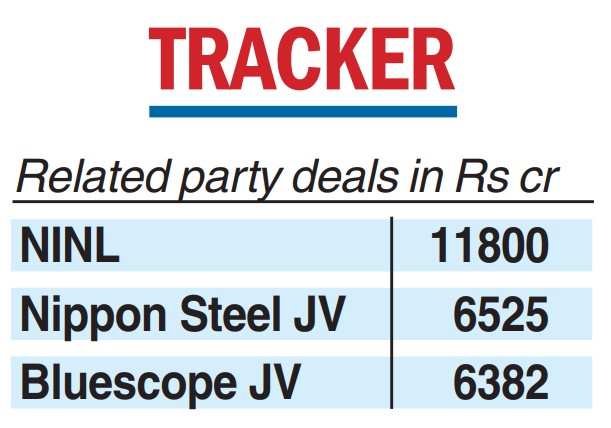

Unlisted Neelachal Ispat Nigam Ltd, which was acquired by Tata Steel’s subsidiary Tata Steel Long Products Ltd last year, will account for the largest chunk of RPT at Rs 11,800 crore, including Rs 800 crore equity subscription. Tata Steel hopes to ramp up production of long products maker NINL to 1.1 million tonnes (my) in FY24.

A joint venture with Nippon Steel of Japan will account for the third largest pie of RPT at Rs 6,525 crore. Tata Steel holds 51 per cent in Jamshedpur Continuous Annealing & Processing Co. Pvt Ltd which supplies steel to the auto companies.

Likewise, a JV with Bluescope Steel for manufacturing sheeting material, coated steel, roof and wall cladding products finds itself in the list where Tata Steel envisages Rs 6,382 crore RPT in FY24.

In both the JVs, Tata Steel plans to extend inter corporate deposits to strengthen their businesses.

Sebi regulations mandate any transaction with a related party shall be considered material, if the transaction(s) during a financial year exceeds Rs 1,000 crore or 10 per cent of annual consolidated turnover of the company, whichever is lower. Prior permission of shareholders would be required for the same.