The Telegraph

Plant shutdown

JLR on Monday revealed plans for a two-week shutdown of its West Midlands plant from October 22 to cope with weakening global demand for its luxury vehicle. The company had, however, said it would not mean any job losses at the plant in Solihull, with workers continued to be paid during the shutdown period.

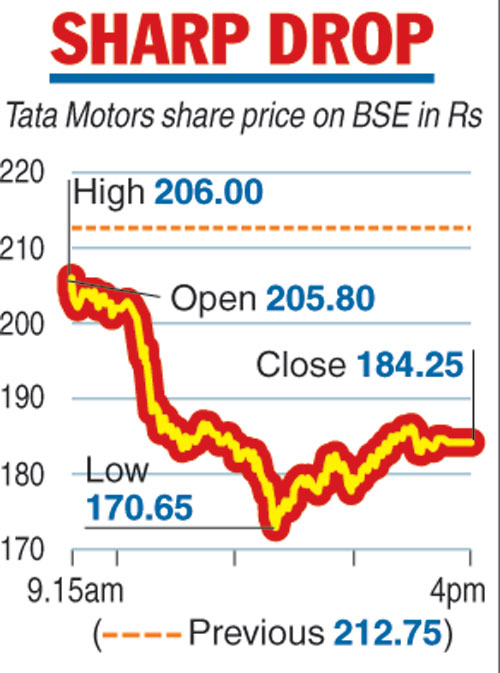

Shares of Tata Motors tanked over 13 per cent after its subsidiary Jaguar Land Rover (JLR) reported a 12.3 per cent decline in global sales in September. A two week shutdown of JLR’s assembly plant at Solihull in West Midlands also contributed to the fall.

On the BSE, the scrip fell 13.40 per cent, or Rs 28.50, to end at Rs 184.25. During intra-day trades, selling pressure saw the counter taking a knock of 19.78 per cent to Rs 170.65, which is almost a seven-year low. Similarly on the NSE, the share dropped 13 per cent to close at Rs 184.55.

The stock was the worst hit among the blue chips on both the key indices. Led by the sharp fall in the stock, the company's market valuation tumbled Rs 8,228.6 crore to Rs 53,199.40 crore on the BSE.

In terms of equity volume, 132.54 lakh shares of the company were traded on the BSE and over 14 crore shares changed hands on the NSE during the day. This drop in the Tata Motors scrip also played a role in dragging the BSE benchmark index lower by 174.91 points to end at 34299.47 points.

JLR on Monday reported a 12.3 per cent decline in global sales at 57,114 units in September, hit by a lower demand in China. Sales in China declined 46.2 per cent in September compared with the same month last year as ongoing market uncertainty resulting from import duty changes and continued trade tensions held back consumer demand.

JLR said its sales were down a modest 0.8 per cent in the UK and 4.7 per cent in Europe. On the other hand, in North America, JLR sales were 6.9 per cent lower, largely reflecting lower industry sales and reduced incentives on Jaguar sedans, it added.

“As a business we are continuing to experience challenges in some of our key markets. Customer demand in China has struggled to recover following changes in import tariffs in July and intensifying competition, while ongoing global negotiations on potential trade agreements have dampened purchase considerations,” Felix Brautigam, Jaguar Land Rover chief commercial officer, said.