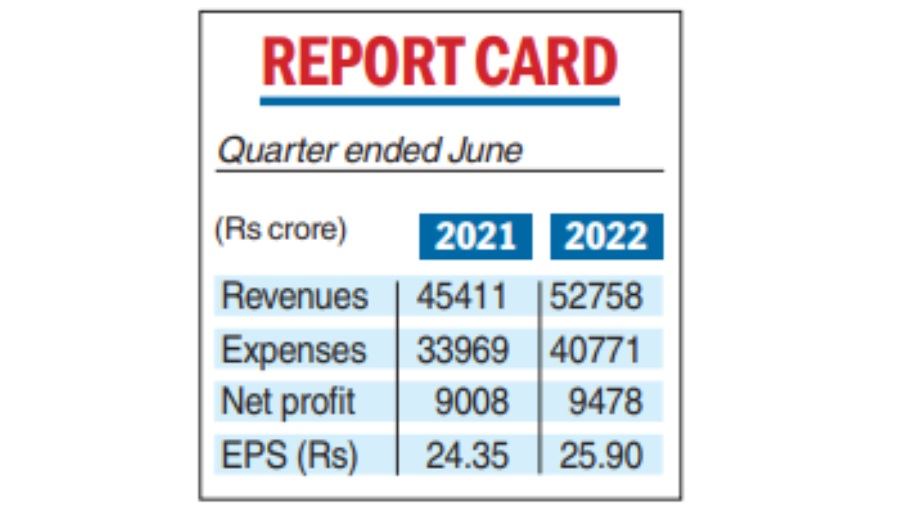

Tata Consultancy Services on Friday reported a 16.2 per cent jump in consolidated revenue for the first quarter of 2022-23 and a 5.2 per cent jump in net profit over the corresponding quarter in the previous year.

Net profit of the IT services major was Rs 9,478 crore for the quarter. Consolidated revenue was Rs 52,758 crore during the period.

TCS is the first among its domestic peers to report earnings, with investors looking to gauge the outlook for the sector which has had a stellar run in the past couple of years with companies expanding their digital offerings during the pandemic.

While the topline numbers met street estimates, the bottomline growth was below expectation with the operating margin being affected by a combination of a salary increase of around 5-8 per cent and costs of employee churn.

Operating margin for the quarter stood at 23.1 per cent, down from 25.5 per cent a year earlier

The IT services major said that it has recorded a net addition of 14,136 employees during the quarter taking the total headcount to 6,06,331 as of June 30, 2022.

The company has also accelerated its return to office program during the quarter, with about 20 per cent of the workforce now working from the office. The attrition rate was 19.7 per cent on a last 12- month basis.

During the quarter, the company added nine clients in the $100 million-plus band and 19 clients in the $50 million-plus band, signifying strong demand which is spread across markets.

Business in the emerging markets grew at a faster pace with India clocking a 20.8 per cent growth compared with 19.1 per cent in North America and 12.6 per cent in the UK and 12.1 per cent in continental Europe.

Growth during the quarter in terms of business verticals was led by retail and CPG (consumer packaged goods) at 25.1 per cent, followed by communications and media at 19.6 per cent and manufacturing at 16.4 per cent. Banking, financial services and insurance (BFSI) which is a key segment for TCS grew 13.9 per cent during the quarter.

Rajesh Gopinathan, CEO and MD of TCS, said that while the company starts the new fiscal on a strong note in terms of pipeline velocity and deal closures, it remains vigilant on the macro-level uncertainties.

“As we look into our client universe and discussions that we are having, we see steady demand as reflected in our pipeline and deal closures. We had total contract signings of $8.2 billion this quarter, which has a couple of deals in the range of $400 million-plus. Client conversations also indicate that demand for technology is robust,” Gopinathan said.

“Our new organisation structure has settled in nicely, getting us closer to our clients and making us nimbler in a dynamic environment. Looking ahead, we remain confident in the resilience of technology spending and the secular tailwinds driving our growth,” he said.

“It has been a challenging quarter from a cost management perspective. Our first quarter operating margin of 23.1 per cent reflects the impact of our annual salary increase, the elevated cost of managing the talent churn and gradually normalising travel expenses,” said Samir Seksaria, chief financial officer, TCS.

“However, our longer-term cost structures and relative competitiveness remain unchanged,” he said.

“During the quarter, we have resumed in-person meetings and hosted several clients at our facilities. We are bringing in more of our associates back at our development centres, and it is steadily increasing at all levels,” said N. Ganapathy Subramaniam, chief operating and executive director of the company.

The TCS scrip at Rs 3,264.85 was down 0.67 per cent over the previous close at the Bombay Stock Exchange.

The company has declared a dividend of Rs 8 per share with a record date of July 16, and a payment date of August 3.