The Specified Undertaking of the Unit Trust of India (SUUTI) is selling part of its stake in Axis Bank. The SUUTI is looking to sell close to 3 per cent of the private sector lender, which may yield the government over Rs 5,300 crore.

The sale should go some way to meet the government’s selloff target of Rs 80,000 crore this fiscal; so far, it has managed to raise a little over Rs 35,000 crore through stake sales in central public sector enterprises.

The Centre had earlier tried to go for a strategic sale of Air India to meet the divestment target but did not find any takers. The SUUTI also holds stakes in ITC and L&T. Investors are watching whether the government will put up these stakes for sale.

Finance minister Piyush Goyal, who presented the interim budget earlier this month, has targeted Rs 90,000 crore to come from disinvestments next fiscal.

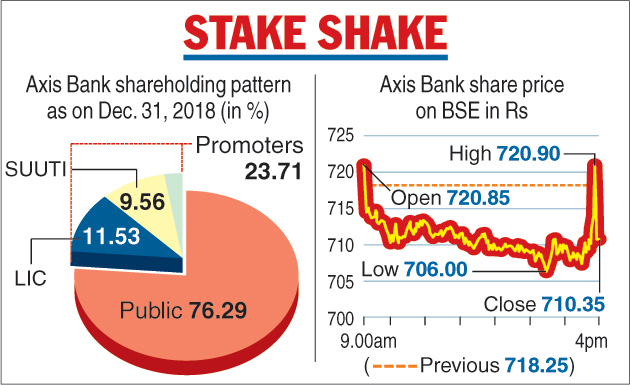

Axis Bank on Monday informed stock exchanges that the SUUTI was proposing to sell about 5 crore shares, or 1.98 per cent of the private sector lender, on February 12. This it said will consist the base offer and open only for non-retail investors.

The Telegraph

On the following day, the SUUTI will look to sell another 2.6 crore shares, or 1.02 per cent stake, which will be the over-subscription option. The sales will be conducted in a separate designated window of the BSE and the NSE.

The floor price has been fixed at Rs 689.52 per share, a discount of almost 3 per cent to the closing price of the Axis Bank scrip on Monday. Shares of the bank closed 1.10 per cent lower at Rs 710.35 on the BSE.

The SUUTI held 9.56 per cent in the bank — till December 31, 2018 — which is valued at around Rs 17,000 crore at current prices.

Set up in 2003, by splitting the erstwhile UTI into two separate entities, the SUUTI holds 1.80 per cent in L&T and 7.97 per cent in ITC.

The government is upbeat on getting a good price from the sale as market sentiment on Axis has improved after a change at the top and the lender reporting better asset quality during the third quarter ended December 31, 2018. This could see the sale eliciting good response from institutional investors.

Gross slippages of the bank during the period declined to Rs 4,428 crore from Rs 8,936 crore in the same quarter last year. Similarly, gross non-performing assets (NPAs) fell to Rs 11,769.49 crore from Rs 14,052.34 crore in the second quarter. Consequently, the percentage of gross NPAs declined to 5.28 per cent from 5.90 per cent, sequentially.

Speaking to the press at a conference call, Axis Bank managing director and CEO Amitabh Chaudhury had said the new goal of the lender was to deliver 18 per cent return on equity on a sustainable basis by focusing on growth, profitability and sustainability. Net profit in the third quarter at the bank jumped two-fold to Rs 1,680.85 crore.