Asia’s billionaire population is set to outpace other regions between 2018 and 2023, according to a global wealth study by property consultant Knight Frank.

The number of billionaires from the region will rise 27 per cent, surpassing growth in North America (17 per cent) and Europe (18 per cent), reaching 1,003 in the next four years — more than a third of the world’s billionaire population of 2,696.

However, the growth is at a slower pace compared with the last period of 2013 to 2018 when the number of billionaires in the region more than doubled to 787 from 363.

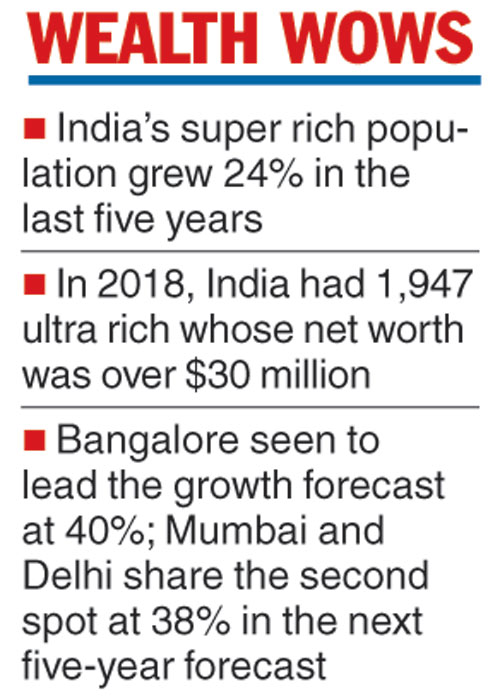

India saw a rise of 116 per cent in billionaire population between 2013 and 2018, while the expected growth of 37 per cent for the next five years (2018 - 23) beats the global and the regional average.

Knight Frank forecasts the global population of ultra-high-net-worth individuals (UHNWIs) will grow more than a fifth over the next five years, and that 2019 will be the first year in which the number of millionaires, as measured in dollars, will pass 20 million.

Liam Bailey, Knight Frank’s global head of research, said: “As wealth moves more rapidly around the world, investors will become increasingly active in their investment strategies. Rising interest rates and the end of quantitative easing mean we are reaching the end of the ‘everything bubble’.”

Bailey went on: “In the past decade, it was enough to buy classic cars, art or property and the generosity of central banks would help deliver super-charged returns. As this process unwinds, property investors will become increasingly focused on income, asset management and development opportunities.”

Echoing the trend seen in the previous editions of the Knight Frank report, Asian countries will also see the fastest growth in UHNWIs, defined as those with net assets of $30 million or more, in the period between 2018 and 2023.

Of the 59 countries and territories in Knight Frank’s forecasts, eight of the top 10 countries by future growth are in Asia, with Ukraine and Romania taking the remaining spots. India leads with 39 per cent growth, followed by the Philippines (38 per cent) and China (35 per cent).

Despite the election uncertainties of 2019, India’s wealth is expected to charge ahead over the next five years with the number of UHNWIs rising to 2,697. Starting from a low base, the Philippines is projected to have 296 UHNWIs by 2023, less than 2 per cent of the projected ultra-wealthy population of Japan, the most prominent Asian wealth hub.

The Telegraph

Among the Indian cities, Bangalore is expected to lead the UHNWI growth in India.

According to the report, the city will see a growth of 40 per cent in UHNWI population, making it the first among the top five future cities in the world. The growth is expected to come out of growth in professional services and innovations, a sign of strong economic fundamentals of the city

Nicholas Holt, head of research, Knight Frank Asia Pacific, says, “Despite softening momentum in the region’s economies, growth prospects in Asia remain favourable in the medium term. While China’s economy is expected to slow, emerging markets such as India and the Philippines will deliver some of the strongest growth over the coming years.”

Though the forecast for long-term wealth creation remains positive, UHNWIs in Asia-Pacific are less optimistic about growing their wealth in 2019, according to the Attitudes Survey. Against the prospect of continued higher interest rates and with the ongoing China and US trade tariffs, wealth advisors in Asia (excluding Australia and New Zealand) were among the least optimistic globally about their clients' ability to create wealth in 2019.

'The uncertainty around US-China trade tensions, a Chinese economic slowdown and Brexit have impacted the regional sentiment for the next twelve months. While a deterioration in any of these situations could further impact sentiment, Asia remains one of the key growth engines of the world economy,' says Nicholas Hoult.

Shishir Baijal, Chairman & Managing Director, Knight Frank India, says, '63% of the world's ultra-high-net-worth individuals saw an exponential surge in their wealth in 2018, clearly showcasing the economic optimism around the globe. Despite a slide in the Indian rupee against the US Dollar, India witnessed a growth in UHNWIs due to heightened economic activity and strong performance of equity markets. Not surprisingly, the growth has been observed in gateway markets of Mumbai and Delhi by 38%. However, Bengaluru is first amongst the top five eye-catching 'cities of the future' based on their future economic potential predicted to witness 40% growth of UHNWIs over the next five years. Indians will continue to remain optimistic in their wealth creation in 2019 as well.'