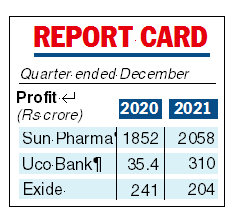

Sun Pharma on Monday posted an 11.14 per cent increase in consolidated net profit at Rs 2,058.8 crore for the third quarter ended December 31, 2021, on the back of robust sales across domestic and international markets.

The Mumbai-based drug major had reported a consolidated net profit of Rs 1,852.4 crore in the October-December period of the previous fiscal. Total revenue from operations rose to Rs 9,863 crore in the third quarter compared with Rs 8,836.7 crore in the same period of previous fiscal.

Uco Bank NII up 25%

Uco Bank on Monday reported a net profit of Rs 310.39 crore for the quarter ended December 31, 2021 against Rs 35.44 crore in the corresponding previous period.

Net interest income of the bank was Rs 1,762.61 crore with a year-on-year growth of 25.26 per cent. Uco Bank said in a statement that it is the highest net interest income earned by the bank.

Gross non performing assets of the bank have reduced to 8 per cent as on December 31, 2021 from 9.8 per cent as on December 31, 2020 and 8.98 per cent as on September 30, 2021. Net NPA has reduced to 2.81 per cent as on December 31, 2021 from 2.97 per cent in the year ago period.

Exide bottomline

High input cost inflation has dampened the bottomline of automotive and industrial battery maker Exide Industries for the third quarter ended December 31, 2021. Standalone net profit during the quarter was at Rs 204.10 crore compared with Rs 241.44 crore in the corresponding period previous year.

Revenue from operations during the quarter was Rs 3196.7 crore compared to Rs 2801 crore in the corresponding period previous year.

Exide said that volumes in the automotive vertical grew over the last year mainly driven by demand recovery in the replacement market. Demand for industrial UPS remain high as pickup in the commercial activity led to increase in orders from offices and industries. This is in addition to the high order inflow seen from the makeshift home offices and data centres, the company said.

During the quarter, the board of directors has granted approvals to set-up a multi-gigawatt lithium ion cell manufacturing plant in India. Also with effect from January 1, 2022, Exide has divested its entire equity stake in the erstwhile wholly owned subsidiary, Exide Life Insurance Company by way of sale of shares in favour of HDFC Life Insurance Company against total sale consideration of Rs 6,687 crore.

“We maintained our strong growth momentum in the third quarter as well, with sales growing at 14 per cent year-on-year. Volume uptick, coupled with calibrated product-market strategies implemented across segments contributed to this growth.

However, due to unprecedented input cost inflation, profitability has been adversely impacted. Overall, volumes have grown in both automotive and industrial verticals,” said Subir Chakraborty, MD and CEO, Exide Industries.

The board of directors has declared an interim dividend of 200% i.e. Rs. 2/- per equity share for 2021-22.