Subhash Chandra and his son Punit Goenka on Tuesday moved the Securities Appellate Tribunal (SAT) against an interim order of the Securities and Exchange Board of India (Sebi) that barred them from holding the position of director or key managerial personnel in any listed firm.

Essel group chairman Chandra and Goenka,the managing director and CEO of Zee Entertainment Enterprises Ltd (Zee), have argued that no show cause notice were issued to them, and the regulator did not follow the principles of natural justice. Sources said the SAT will hear their appeal on Thursday.

On Monday, in a late-evening interim order, the market regulator said both Goenka and Chandra cannot hold key posts in any listed companies or its subsidiaries until further orders for allegedly siphoning off funds for their own benefit.

Zee chairman R. Gopalan said in a statement that the company’s board was “in the process of reviewing the detailed order, and appropriate legal advice is being sought in order to take the next steps as required”.

“All the appropriate steps will be actioned as necessary, in order to ensure that the interest of the company and all its valuable shareholders is kept at the forefront.”

With a singular focus on enhancing the shareholder value year after year, the board has continued to guide the management towards its strategic goals and priorities for the future, the statement said.

Gopalan also said the board recognises the significant contribution madeby Chandra as the founder of the company and the growth and value generation-centric leadership showcased by Goenka.

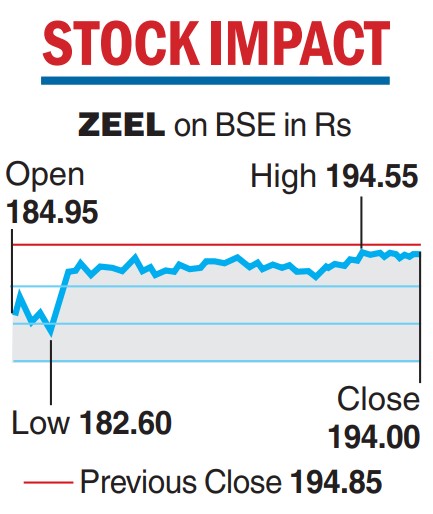

Sebi’s action led to the Zee scrip crashing at the bourses on Tuesday, though it recovered from the lows to close with minor cuts following the statement given by Gopalan.

After opening lower at Rs 184.95, the share skidded to an intra-day low of Rs 182.60 — a fall of 6.28 per cent. The counter later clawed back and settled at Rs 194, down 0.44 per cent over its last close.

The development has raised fresh questions about the future of Zee’s much awaited merger with Culver Max Entertainment, formerly known as Sony Pictures Networks India (SPNI). Analysts said that while the merger process could now be delayed, Sony is unlikely to walk out from the deal.

At the same time it is felt that if the Zee promoters not get any relief, Goenka may not be able to hold the position of key managerial person which may then see the appointment of a new CEO for the merged entity.

In its interim order, Sebi said that Chandra and Goenka alienated the assets of Zeeand other listed companies of the Essel group for the benefit of associate entities, whichare owned and controlled by them. Sebi alleged that the siphoning of funds appears to be a well-planned scheme since in some instances, the layering of transactions involved using as many as 13 firms as pass-through entities within a short period of only two days.