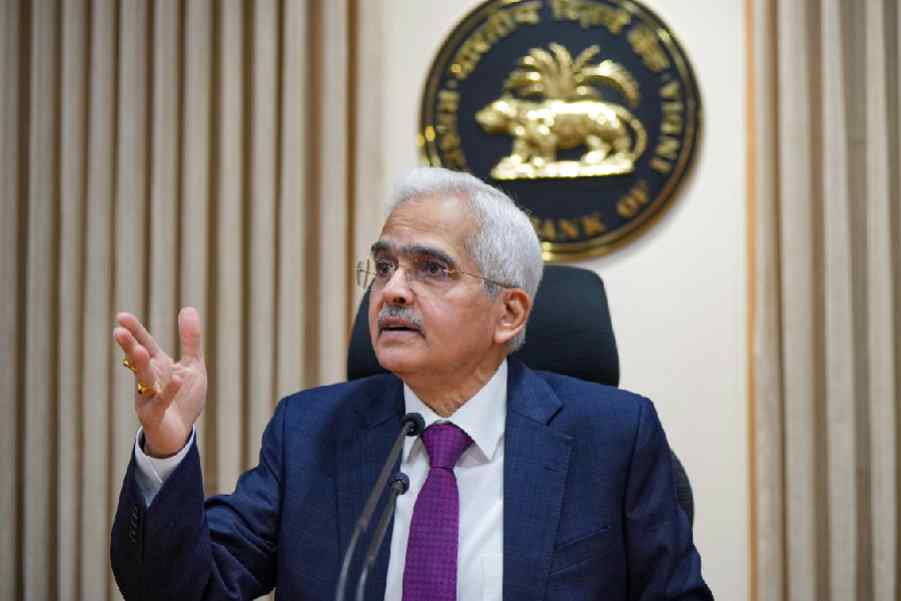

The strong growth momentum and the GDP projections for 2024-25 give the RBI a policy space to unwaveringly focus on price stability, Governor Shaktikanta Das stressed while voting for a status quo in the interest rate earlier this month.

The Reserve Bank had maintained status-quo on the benchmark lending rate (repo) at 6.5 per cent since February 2023 on concerns over inflation after the three-day meeting of the Monetary Policy Committee (MPC) earlier this month.

The central bank on Friday released the minutes of the meeting.

"The gains in disinflation achieved over last two years have to be preserved and taken forward towards aligning the headline inflation to the 4 per cent target on a durable basis," he said, according to the minutes.

Five of the six MPC members had voted for the status quo in the policy rate.

MPC member Jayanth R Varma, however, had advocated a reduction in the repo rate by 25 basis points as "high interest rates entail a growth sacrifice".

Except for the headline, this story has not been edited by The Telegraph Online staff and has been published from a syndicated feed.