Stocks rallied for the second consecutive session on Thursday as investors overcame reverses from the election results and focused on government formation at the Centre where the two alliance partners of the BJP could bargain hard.

With political worries easing and Narendra Modi set to take oath for the third time on Saturday, the 30-share Sensex regained the 75000-level as it rallied 692.27 points, or 0.93 per cent, to end at 75074.51.

During intra-day trades, the gauge jumped 915.49 points or 1.23 per cent to hit a day’s high of 75297.73.

On the NSE, the Nifty climbed 201.05 points or 0.89 per cent to finish at 22821.40 after surging 289.8 points during intra-day trades to 22910.15.

Investor attention will shift to the Reserve Bank of India (RBI) which will announce the monetary policy on Friday. Analysts, however, feel the event is unlikely to have any material impact on stock prices since the repo rate will be retained at 6.50 per cent for the eighth consecutive time.

The street will be watching for any indications from the monetary policy committee (MPC) about a potential cut in the future, apart from its inflation and growth projections for the fiscal.

On the eve of its decision, the European Central Bank cut interest rates 25 basis points for the first time in five years following lower inflation.

IT stocks which now figure on the defensive list grabbed investor attention with Tech Mahindra and HCL Technologies leading the gainers as they rose up to 4.07 per cent.

The FMCG space saw some profit booking with Hindustan Unilever declining 2.04 per cent and Nestle, 1.40 per cent.

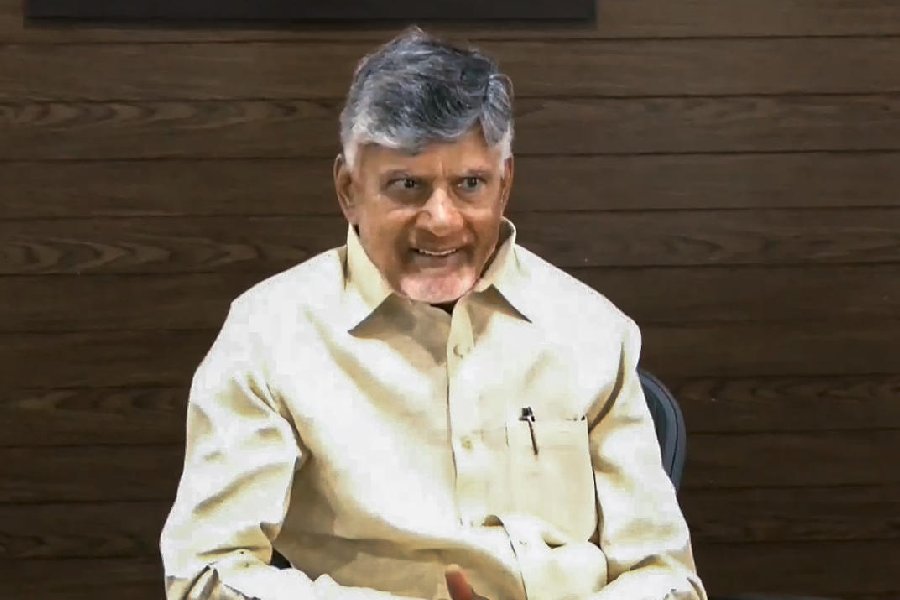

Market watchers said that stock specific action would be seen over the short-term as investors assess the sectors that could receive more attention from the new government which is backed by two regional parties — JD (U) and the TDP.

``Investors heaved a sigh of relief as the confidence strengthened post two key allies pledged their support to form a new government with the BJP. Even global factors contributed to the rally as the hopes revived for rate cut possibility in US Fed’s September meet, after weaker than expected jobs data,’’ Siddhartha Khemka, head — retail research, Motilal Oswal Financial Services, said.

AP connection

With the TDP (Telugu Desam Party) being a key ally of the government, companies based in Andhra Pradesh have seen hectic buying activity.

Heritage Foods, a company linked to N. Chandrababu Naidu’s son Nara Lokesh, zoomed nearly 10 per cent to close at ₹601.60.

As per the shareholding data of the company, Lokesh holds 10.82 per cent of its equity.

The other promoters include Bhuvaneshwari Nara, the wife of Chandrababu Naidu (24.37 per cent) and Devaansh Nara (Nara Lokesh’ son at 0.06 per cent).

Apart from Heritage Foods, investors also scouted for Amara Raja Energy & Mobility, which gained 4.91 per cent to close at ₹1,275.65 on the BSE. The company is promoted by Galla a two-term TDP MP from Guntur. He did not contest the election this year.

Avanti Feeds (up 7.99 per cent), Andhra Cements (3.28 per cent), Andhra Sugars which gained 2.2 per cent were the other stocks that rallied.

“It appears that markets have adjusted to the recent election results, and stability on the global front is further boosting positivity,” Ajit Mishra — SVP, research, Religare Broking Ltd, said. In the broader market, the BSE smallcap gauge jumped 3.06 per cent, while the midcap index rose 2.28 per cent.

Gold shines

Gold prices jumped ₹680 to ₹73,500 per 10 grams in the Delhi market on Thursday amid a jump in the precious metal rates internationally, according to HDFC Securities.

The yellow metal had closed at ₹72,820 per 10 grams in the previous session.

Silver also rallied ₹1,400 to ₹93,300 per kg against ₹91,900 per kg in the previous session.

A pullback in the US Treasury yield and mixed US macroeconomic data led to an uptick in gold prices.

Silver also trading higher at $30.30 per ounce. It had settled at $29.75 per ounce in the previous close.