The Nikkei India Manufacturing Purchasing Managers' Index eased to 53.2 in December from 54 in November.

Reflecting the trend, the 30-share BSE Sensex opened lower at 36198.13, fell below the 36000-mark to hit an intra-day low of 35734.01 and later closed at 35891.52 — a fall of 363.05 points or 1 per cent. The broader NSE Nifty plunged 117.60 points, or 1.08 per cent, to settle at 10792.50.

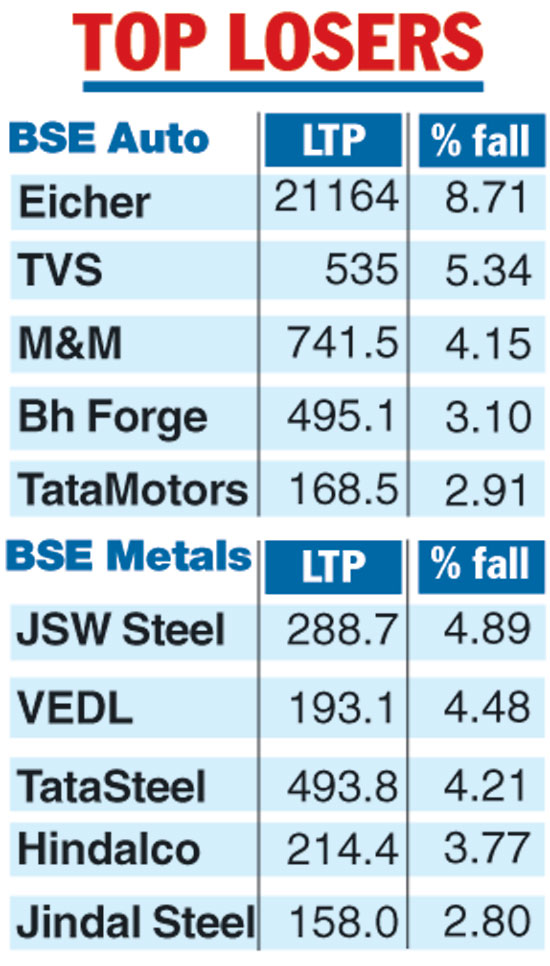

Metal stocks were hit hard as it is feared the sector will be adversely affected by any slowdown in China. Auto stocks reacted to the December sales numbers.

The biggest losers in the Sensex pack were Vedanta, Tata Steel, M&M, Tata Motors, Maruti, Hero MotoCorp, PowerGrid, Bharti Airtel, SBI and Coal India — falling up to 4.48 per cent. Sectorally, auto and metal indices took the worst hit, falling over 3 per cent.

While investors will now focus on corporate results that will kick off next week, market circles are of the view that global factors will continue to have its impact. Some experts remain optimistic.

“Selling pressure was seen on account of the fall in global markets. I expect the index (Nifty) to test 11000 levels back in the next few trading sessions and suggest using this correction as a buying opportunity. We expect the pace of the up-move to be slow but remain confident of a breakout of the trading range,” Sahaj Agrawal, Derivatives Analyst, Kotak Securities said.

A day after ringing in the New Year on a positive note, investors were in for a heartbreak on Wednesday as fears over the impact of a slowdown in China amid disappointing auto sales and GST collection numbers back home saw the benchmark index crashing over 363 points.

Profit booking was triggered after adverse cues came in from overseas markets, which opened weak following the year-end holidays on apprehensions that a slowdown in China could pull down most global bourses.

In Asia, while South Korea’s Kospi ended 1.52 per cent lower, Hong Kong’s Hang Seng fell 2.77 per cent and the Shanghai Composite Index slipped 1.15 per cent.

Similarly, in Europe, Paris’s CAC shed 1.95 per cent, while Frankfurt’s DAX fell 0.76 per cent and London’s FTSE by 1.28 per cent.

To compound matters for the investor in India, auto sales were weak during December. Moreover, GST collections continued to disappoint as they dropped to Rs 94,726 crore in December, lower than Rs 97,637 crore in the previous month.

Traders were also tracking the PMI data, which revealed that the country’s manufacturing sector activity in December slowed down from the previous month.

The Telegraph