Weak global cues and profit booking saw equity markets end the week on a gloomy note with the BSE Sensex tanking almost 690 points.

Concerns of a slowdown in global economic growth and fears of a potential US government shutdown and rising tension between the US and China weighed on markets across the world.

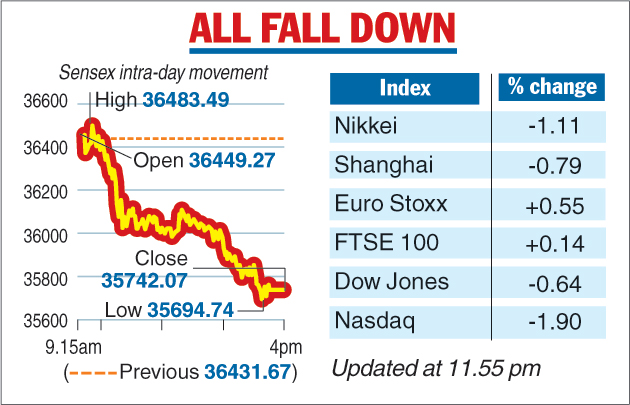

In Asia, Japan’s Nikkei plunged 1.11 per cent and the Shanghai Composite Index slipped 0.79 per cent.

Similarly, in Europe, Frankfurt’s DAX, Paris’s CAC 40 and London’s FTSE slipped during early trade. They later recovered to close in the green. The Dow Jones and Nasdaq were trading in the red during early trade.

The disappointing close back home comes at a time falling crude prices have provided some relief to investors already hurt by lacklustre second quarter results from corporate India, elections in five states and the tiff between the Reserve Bank of India (RBI) and the government, which culminated in the resignation of RBI governor Urjit Patel.

Analysts said the attention will now be focused on the GST Council meeting on Saturday and any rationalisation in duties is likely to be welcome.

While the 30-share BSE sensex opened marginally higher at 36449.27, global factors and profit booking dragged it to a day’s low of 35694.74 — a fall of 736.93 points. It later settled at 35742.07, thus showing a drop of 689.60 points, or 1.89 per cent.

Similarly, the broadbased Nifty 50 slipped 197.70 points, or 1.81 per cent, to 10754.

Barring only two stocks in the Sensex pack, the rest ended in the red. IT, auto and financial stocks witnessed heavy selling. Adani Port was the biggest loser with its shares falling 4.24 per cent and was followed by Wipro, Maruti, Infosys and TCS.

Among the financial stocks, ICICI Bank fell 2.46 per cent. Other heavyweights such as Reliance Industries and HDFC Bank, too, witnessed selling. NTPC and Coal India were the only gainers in the Sensex pack.

Telegraph infographic

Rupee under pressure

The rupee, too, came under pressure on the weak stock markets even as crude oil prices inched up.

At the inter-bank forex markets, the domestic unit fell below the 70-mark to end at 70.15 — a fall of almost 45 paise — against the dollar.

ICICI view

ICICI Bank on Friday said it expects India’s economy to grow at 7.4 per cent in the next financial year, supported by the ongoing recovery in investment growth.

Consumer price inflation is expected to hover around 4 per cent in the first half of next year. It also expects the Monetary Policy Committee (MPC) to change its stance to neutral from calibrated tightening in February 2019, even as the probability of a rate cut is strong.

As regards the rupee, the private sector bank expects the currency to strengthen towards 69 by March 2019, and trade around 69-72 against the dollar in the next fiscal.