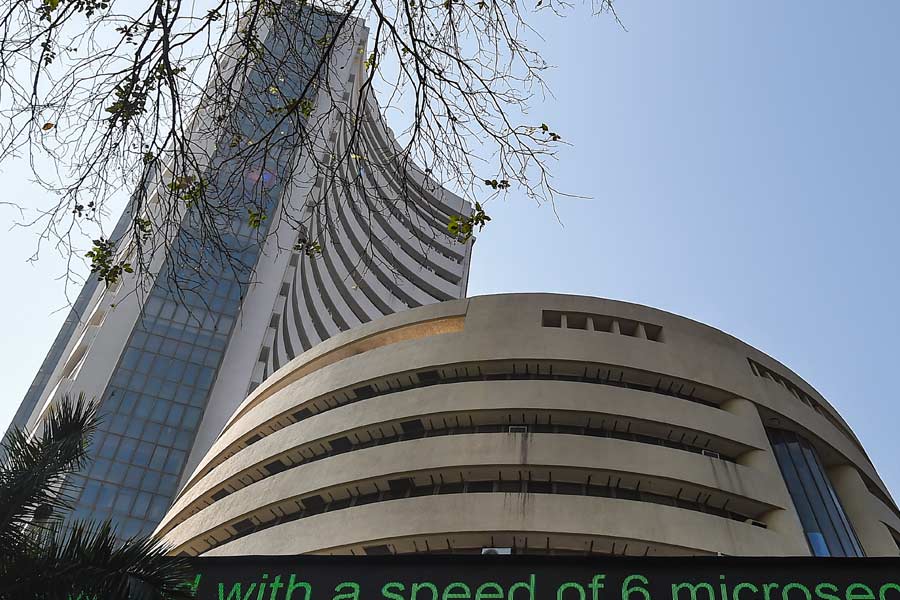

Stocks overcame initial weakness and closed sharply higher in volatile trade as investors eyed liquidity support from the Reserve Bank of India (RBI) to boost the sagging Indian economy amid strong buying from foreign portfolio investors (FPIs).

The 30-share Sensex, which crashed nearly 489 points to an intra-day low of 80467.37, rebounded in noon trades as market participants bet on the central bank announcing some liquidity infusing steps in its monetary policy announcement on Friday — not in the form of a rate cut but possibly a reduction the cash reserve ratio.

The Sensex surged 1361.41 points to hit an intra-day high of 82317.74 and it ended with gains of 809.53 points at 81765.86. On the NSE, the Nifty surged 240.95 points to settle at 24708.40

Analysts said the rally received a fillip from FII buying. Provisional data from the exchanges showed them purchasing stocks worth ₹8,540 crore on Friday.

Moreover, data which showed a slowdown in the US services sector growth backed the positive sentiment as investors started betting on a rate cut by the US Federal Reserve on December 18.

The five consecutive days of gains has resulted in investors’ wealth zooming ₹15.18 lakh crore. During these sessions, the Sensex has jumped 2722.12 points or 3.44 per cent.

“Nifty surged for the 5th straight day, closing 0.98 per cent higher at 24708, despite intraday volatility. The Nifty joined global markets in optimism, following new highs on the Dow, S&P 500 and Nasdaq. Bank Nifty also gained 0.63 per cent, while IT stocks rallied 1.95 per cent,” Prashanth Tapse, senior vice-president (research), Mehta Equities Ltd, said.

The volatility gauge as measured by India VIX rose 0.48 per cent to 14.52.

At the forex markets, the rupee closed sideways at 84.73 to the dollar against its previous level of 84.74. This came as the dollar index which measures the US unit’s strength against six other currencies was steady overseas.