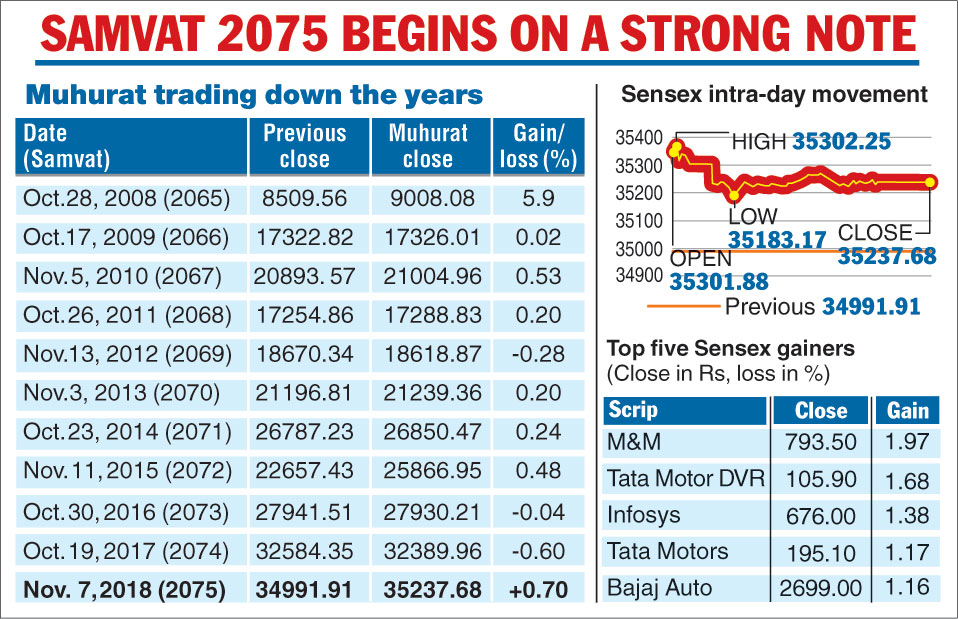

Investors kicked off Samvat 2075 on a positive note, with the benchmark Sensex rising almost 246 points making it the best return given on a Muhurat trading day in nine years.

It was on the Diwali day of October 28, 2008 that the Sensex had surged a whopping 498 points. Since then, trading during the special session that marks the start of the new year on bourses had remained in a narrow range and the best show was in 2015 when it rose 124 points.

In Wednesday’s 90-minute session, the 30-share Sensex, opened above the 35000-mark at 35301.88 and quickly touched 35302.25, marking an intra-day gain of over 207 points on the back of hectic buying. It shed some ground on profit-booking and finally settled 245.77 points, or 0.70 per cent, higher at 35237.98.

Mirroring the Sensex, the broader NSE Nifty, after crossing the 10600-mark, settled 68.40 points, or 0.67 per cent, higher at 10598.40.

A similar trend was seen in the broader markets as investors accumulated stocks available at attractive levels. The BSE small-cap index jumped 1.08 per cent and the mid-cap gauge gained 0.62 per cent.

Brokers said buying activity gathered momentum as investors opened their new books on the first session of Samvat 2075. Wednesday’s gain comes despite investors being confronted with disappointing news.

Corporate results announced so far have been a mixed bag. The markets have also been worried over the tiff between the central government and the Reserve Bank of India (RBI) even as non-banking finance companies continue to face a liquidity squeeze.

The key event that will be watched is the RBI board meeting on November 19.

On the positive side, however, crude oil prices have cooled down and the rupee has also recovered against the dollar.

Experts who expect volatility this year, feel elections in five states followed by the general polls next year could be key factors in determining the market’s course. Despite the uncertainty on this front, few optimists even feel the Sensex will be around the 40000-mark by next Diwali.

“Samvat 2075 will see two mega events. The first will be the state elections and then the general polls. There will be some impact post the results. For the markets, one thing that can go wrong is if there is a fractured mandate in the 2019 elections.

“However, on the other hand, we have the GST which is a game changer. While its impact will be felt with every passing quarter, corporate results could also improve. Though we could have a difficult six months ahead, this is a good time to invest,” Arun Kejriwal, founder, Kris, told The Telegraph.

He feels if there is no “political mishap” in the general elections, the Sensex may rise anywhere between 8000 points and 10000 points by the next Samvat.

In Wednesday’s trading while Bharti Airtel and Axis Bank were the only losers in the Sensex pack, the gainers list was led by Mahindra & Mahindra whose shares rose nearly two per cent. It was followed by Infosys, Tata Motors, Bajaj Auto and Hero Motocorp.

Globally, Wall Street stock futures rose Wednesday after Democrats won control of the US House of Representatives, boosting the party’s ability to block President Donald Trump’s political and economic agendas.

According to the available provisional data, domestic institutional investors (DIIs) bought shares worth Rs 118 crore, while foreign institutional investors (FIIs) sold equities worth Rs 499.7 crore on Tuesday.

In the Asian region, Hong Kong’s Hang Seng rose 0.10 per cent, while Taiwan was up 0.85 per cent. Japan’s Nikkei, however, shed 0.28 per cent.

In Europe, Paris CAC 40 surged 1.36 per cent, Frankfurt's DAX gained 1 per cent, while London's FTSE rose 1.17 per cent in early deals.

Gold falls

Gold prices dropped Rs 210 to Rs 32,400 per 10 grams in a special muhurat trading at the bullion market in New Delhi on Wednesday. Tracking gold, silver too fell by Rs 300 to Rs 39,000 per kg.

Bullion traders said the slide in gold prices was mostly because of the absence of worthwhile activity as jewellers and retailers made token purchases to mark the occasion

Globally, gold rose 0.51 per cent to $1,233.80 an ounce and silver climbed 0.17 per cent to $14.77 an ounce.

In the national capital, gold of 99.9 per cent and 99.5 per cent purity traded lower by Rs 210 each to Rs 32,400 and Rs 32,250 per 10 grams, respectively. The precious metal had shed Rs 80 on Tuesday.

Sovereign, too, weakened by Rs 100 to Rs 24,800 per piece of eight grams.

In line with overall trend, silver ready fell Rs 300 to Rs 39,000 per kg while weekly-based delivery lost Rs 316 to Rs 38,128 per kg.

Silver coins were unaltered at Rs 76,000 for buying and Rs 77,000 for the selling of 100 pieces.

The BSE and NSE will remain closed on Thursday on the occasion of “Diwali Balipratipada”.