The Sensex zoomed 1921 points — its biggest single-day jump in a decade — and investor wealth surged a whopping Rs 6.8 lakh crore following the surprise fiscal stimulus measures announced by the government on Friday.

Union finance minister Nirmala Sitharaman has announced a slew of measures that included bringing down the base corporate tax for

existing companies to 22 per cent from 30 per cent and for new manufacturing firms, incorporated after October 1, 2019, to 15 per cent from 25 per cent.

The steps came as a pleasant surprise to the markets that had given up hopes of a stimulus as many felt that given the tepid tax collections, the space for such a programme was limited.

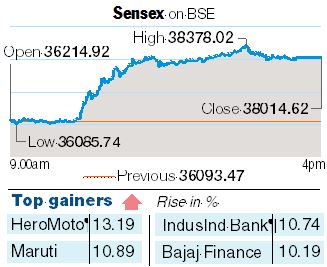

The stocks leapt after the announcements and maintained the tempo all day. The BSE Sensex, which began with gains of over 121 points at 36214.92, hit an intra-day high of 38378.02 — a rise of 2163 points — and settled 1921.15 points, or 5.32 per cent, higher at 38014.62.

Similarly, the broader NSE Nifty zoomed 569.40 points, or 5.32 per cent, to end at 11274.20. This was the second highest rise in its history since its launch in April 1996. For the Nifty 50, the largest percentage gain was in May 18, 2009 when it shot up 17.74 per cent.

The market capitalisation of BSE-listed companies jumped to Rs 145,37,378 crore from Rs 138,54,439 crore on Thursday. Cash-market equity turnover on the BSE and the NSE nearly tripled to Rs 90,000 crore, while derivatives turnover also rose to about Rs 2.4 lakh crore.

The announcements led to brokerages raising their EPS estimates even as analysts contended that it will have a positive impact on the industry. It is also felt that the measures should see foreign portfolio investors (FPIs) returning to their buying ways in the domestic markets.

Incidentally, provisional data showed that the overseas investors made net purchases of only Rs 35 crore on Friday, while domestic institutions were the major buyers with the numbers standing at over Rs 3,000 crore.

“FPIs will take the announcement very positively and flows will drive the market going forward,’’ a note from Kotak Securities said.

The brokerage however, added that the effective tax rate of Nifty companies on an aggregate basis was 26 per cent which will now come down to 25.17 per cent and that there are only 20 Nifty companies which paid more than 30 per cent effective tax rate and accounted for 43 per cent of overall net profit in 2018-19.

Meanwhile, the rupee gained 40 paise to settle at 70.94 to the dollar.

Negative impact

Bonds reacted differently to the stimulus measures. Yields on the benchmark 10-year security rose 15 basis points on worries of a fiscal slippage which may lead to higher borrowings from the Centre.

Yields on the benchmark security closed at 6.79 per cent-a rise of around 15 basis points (yields are inversely related to prices) after rising to 6.89 per cent during intra-day trades.

The initial estimate is that the fiscal deficit could rise to anywhere between 3.7 per cent and 4 per cent of GDP against a target of 3.3 per cent for 2019-20.

A note from the SBI economic research wing said that the government should look at issuing overseas sovereign bonds and raise Rs 70,000 crore. Additionally, it could enlarge borrowing from small savings to Rs 20,000 crore.