The Telegraph

“There is a slowdown in China’s property and auto markets. Moreover, unlike last year, the Chinese government has not ordered a 50-million-tonne blanket production cut in the winter months to curb pollution. Instead, they asked provincial authorities to decide on the amount of cut based on local requirement. The ongoing trade war has raised concerns over the global economy. All put together there is a downward pressure on the prices,” Roy told The Telegraph.

Seaborne steel price (free on board), which were hovering around $560 a tonne, has now come down to $480 a tonne by the end of November. However, it would take at least another 30-45 days before the steel contracted at those prices hit the Indian shore.

The anti-dumping duty imposed by the Indian government on basic HRC has not kicked in as yet but will do so if the landed cost goes below $489 per tonne

One reason why the stock market is less than kind to the steel scrips could be that companies’ profit margin will be squeezed under the present circumstances.

Raw material prices, coal and iron ore are yet to come down as much as steel. Iron ore prices have corrected 7 per cent, while coking coal prices are ruling at $225 a tonne (free on board, Australia) in end November, up from $173 a tonne in July.

Only Tata Steel and SAIL meet the entire iron ore requirement from their own mines, while JSW and JSPL buy the majority from the market.

In the case of coking coal, Tata and SAIL are the only ones who partly meet the need from captive sources, while the rest are fully dependent on imports.

According to an Icra report, the possibility of a downward revision in domestic flat steel prices in the coming months is likely to lead to a sequential contraction in the gross contribution of a domestic blast furnace-based flat steel player by around $20 per million tonnes (mt) in the third quarter of 2018-19 and by a sharper $45 per mt in the fourth quarter, unless raw material prices start softening.

Multiple price cuts along with international headwinds are taking the sheen off the spectacular rally in steel scrips this year.

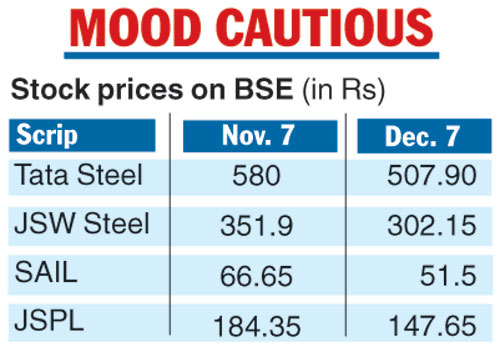

Stocks of all integrated majors – Tata Steel, JSW Steel, Jindal Steel & Power, SAIL – underperformed the broad-based indices last month as steel makers brace for further price cuts in the wake of a China slowdown, a less-than-anticipated output cut during winter and a weak outlook on the global economic growth.

SAIL led the pack on the downside correcting 24 per cent over one month, while Tata Steel corrected the least after prices fell following nearly a year-long steady rise. There have been two cuts in November, while the one in December is expected on Monday.

“Put together, flat steel prices are likely to be moderated by Rs 3,000 per tonne,” an executive with a Mumbai-based steel giant said over the weekend. Benchmark hot-rolled coil (HRC) prices are hovering around Rs 44,000-45,000 ($633) per tonne.

Jayanta Roy, senior vice-president of Icra, said three factors were pushing global prices down, which in turn is putting pressure on the Indian prices.