After sliding for eight months, steel prices in November bucked the trend, inching up Rs 500-Rs 1,000 a tonne as a seasonal pick-up in construction activity and international dynamics worked in favour of a modest recovery.

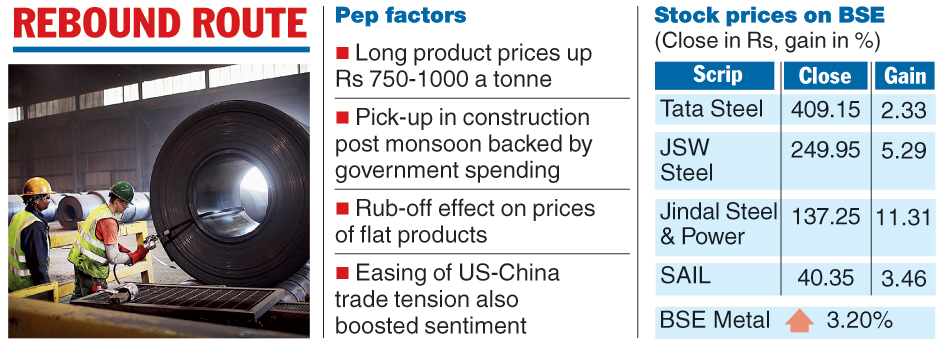

The shares of all the major players were quick to reflect the directional shift in the prices on Monday. Investor interest pushed up the stocks of leaders such as Tata Steel, JSW Steel, SAIL and Jindal Steel & Power Ltd by 3-11 per cent on the first day of trading of the week.

The industry attributed the recovery to multiple factors, domestic as well as international. Demand for long products, such as TMT bars used in the construction sector, were showing traction from the middle of last month with the monsoons retreating and the government increasing expenditure in the sector.

International factors also worked in favour as prices in China, the world’s largest producer of the alloy, witnessed a marginal increase as it moderated production.

“Long product prices went up by Rs 750-1,000 a tonne from middle of last month and it had a rub-off effect on flat products (sheets and coils that goes into the production of automobile and consumer durables) prices, which have gone up by Rs 500-750 a tonne,” Jayant Acharya, director of commercial, marketing and corporate strategy of JSW Steel, told The Telegraph.

The Telegraph

He was quick to point out that it was a directional change rather than a rebound, underscoring the need to remain cautiously optimistic for the rest of the year.

An official of a leading private sector steel player said inventories outside the factory gates were low and imports to India have also reduced.

“Moreover, the raw material prices continue to remain high, thereby squeezing the margin of steel players,” the official said.

Acharya concurred with the official. He pointed out that sales of automobiles have perked up in the festive months, destocking the channel at the retailer level.

There is an expectation that the sales of automobiles may rise by the end of the fiscal as buyers rush to beat the BS-VI emission norm deadline, which will come into effect from April 2020, increasing the prices of cars.

Consumption in the construction sector will, however, be driven by government spending as activity in the real estate industry, powered by the private sector, continues to remain weak. “We can see some green shoots in public spending,” Acharya noted.

India Ratings & Research, a Fitch group company, noted that metal prices have corrected 17-25 per cent in the first half of this fiscal. The industry expects steel demand to rise 5.5 per cent this fiscal.

RCEP exit relief

Steel players expressed relief on the government’s decision not to join the RCEP trade block. The industry had pleaded with the Centre to keep the sector out of the free trade pact to protect the domestic industry from cheaper imports from China and South Korea.