The Telegraph

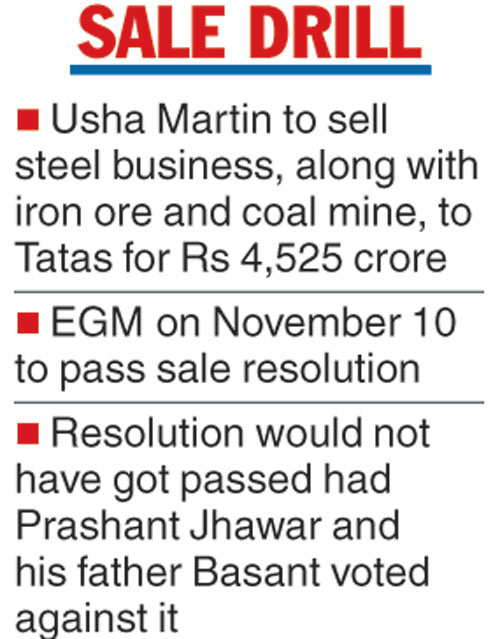

The dissenting promoter group of Usha Martin Ltd (UML) has decided to back Tata Steel’s bid to buy out the steel business, clearing the decks for the Rs 4,525-crore deal.

Father-son duo Basant K. Jhawar and Prashant Jhawar, who hold a 25.5 per cent stake in steel, wire and wire rope maker UML, said on Monday they would vote in favour of the resolution in the forthcoming extraordinary shareholders’ meet on November 10.

The Jhawars have also written a letter to the State Bank of India, the lead banker for UML, informing it of their decision to support the proposal to carve out the steel business and sell it to Tata Steel subsidiary Tata Sponge.

They have authorised legal firm Shardul Amarchand Mangaldas to vote in favour of the special resolution, which would not have been passed without their nod as it required three-fourths majority.

The father-son duo is at loggerheads with UML’s other promoter group belonging to Rajeev Jhawar and his father Brij Jhawar. Rajeev Jhawar is the managing director of the company that his uncle Basant Jhawar had founded decades ago.

Prashant Jhawar, who had succeeded his father Basant as the chairman of UML before being ousted by the board, led by the lenders and independent members, did not unequivocally support the transaction when it was first announced on September 22.

Although he described the Tatas as “an excellent business house” and said the “transaction with Tata Steel is overall a positive development”, he questioned the utlisation of the sale proceeds. “No details are available, creating doubt over transparency and management accountability,” a statement issued by Prashant and Basant Jhawar read.

The Usha Martin board and management came up with a detailed response soon after, adding that it was committed to paring debt with the sale proceeds, which will be first used to repay the lenders.

Prashant Jhawar had also suggested to the board that the entire business, the steel division at Jamshedpur and the wire and wire rope business in Ranchi, be sold to the Tatas.

On Monday, Prashant Jhawar continued to raise concern over the utilisation of the sale proceeds but also agreed to support the deal.

“We had earlier welcomed the possible involvement of the Tatas in the management of Usha Martin’s steel division. To facilitate this, we have instructed our lawyers to support the resolution for the sale of the steel division of Usha Martin to Tata Sponge Iron Ltd at the forthcoming shareholders meeting. We have also conveyed our decision to the lead banker, the State Bank of India,” Prashant Jhawar, who is based in London, said in a statement.

He also pointed out that the company continued to carry a large contingent liability of Rs 860 crore which might force the residual wire rope business to take fresh loans to pay it off.