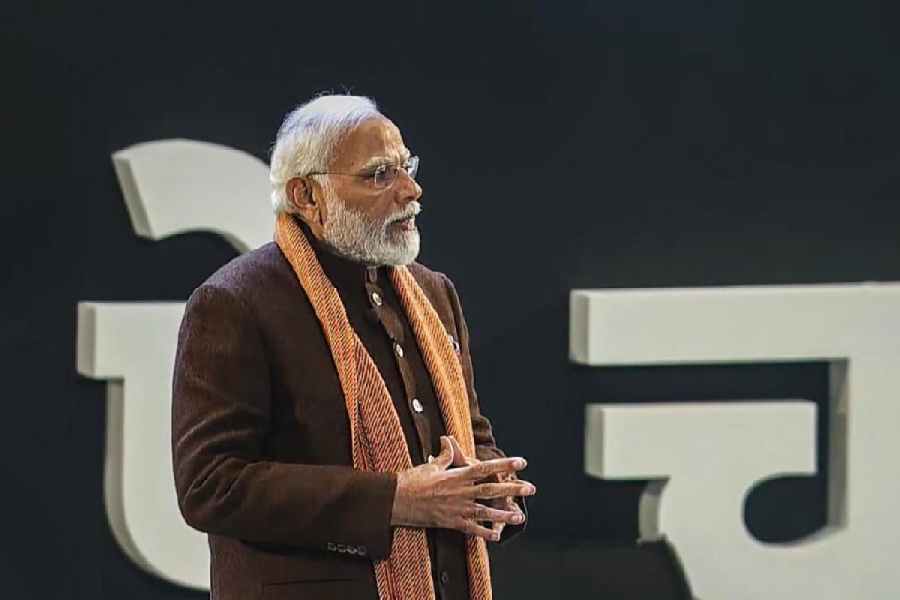

Prime Minister Narendra Modi met economists on Thursdays and discussed measures for inclusive growth and massive job creation, days prior to the Union budget on July 23.

The meeting was attended by finance minister Nirmala Sitharaman, Niti Aayog vice-chairman Suman Bery, Planning minister Rao Inderjit Singh and chief economic advisor V. Anantha Nageswaran.

Economists Surjit Bhalla and Ashok Gulati and veteran banker K.V. Kamath were also present along with sectoral experts and other economists.

The economists have urged the government to provide tax relief to the common man to boost consumption.

Speculations are rife that major tax reforms will be introduced, including increasing the threshold for standard deduction and a possible restructuring of capital gains taxes. The MSME sector has proposed relaxing the 45-day payment rule, to prevent large corporations from looking at other sourcing avenues.

Meanwhile, Bank of America in a report said it expects the budget to retain the fiscal deficit target of 5.1 per cent of GDP with a high chance of eventual over achievement. It expects higher than budgeted non-tax revenues to provide for tax cuts, higher subsidies and more financial assistance to states.

The report said sovereign green bonds worth about ₹25000-30000 crore are likely in the second half of the fiscal, higher than ₹20000 crore issued in 2023-24 and ₹16,000 crore in 2022-23.