The Telegraph

Abhirup Nandy Telegraph picture

The Telegraph

Arpan Saha Telegraph picture

The Telegraph

Saheli Kar Telegraph picture

Sunandita Dey Telegraph picture

The Telegraph

Mousumi and Arindam Ghosh Telegraph picture

Hardly anything for us in these measures

Nirmalya (44) and Anindita Dhar (38) live in Calcutta. Their son Ankan (11) is in fifth grade. Nirmalya heads a projects and engineering team of a global steel major, while Anindita is a home-maker. The couple invests in mutual funds to save on taxes.

As a family with a substantial home loan and a school-going kid, they would want the deduction limit under section 80C to be raised. Similarly with deduction on home loan interest, Nirmalya feels that the limit should be much higher considering the amount of interest he pays on his home loan.

Nirmalya and Anindita want to see the world, while saving enough for their son’s higher education. A change in the income tax slabs which would increase his net take home salary is on Nirmalya’s wish list too. Measures to reduce the price of basic goods will be a welcome move.

Budget reaction

The budget is a big disappointment. We have to keep servicing our substantial home loan for quite sometime. But if we opt for the new tax regime we will have to forego the benefits available on home loan principal and interest. “As a father of a school going child, I get benefits on fees paid and also for buying medical insurance cover for my family. My investment in PPF is a long-term commitment. For tax payers in my bracket there is zero benefit,” says Nirmalya.

What the taxpayer loses

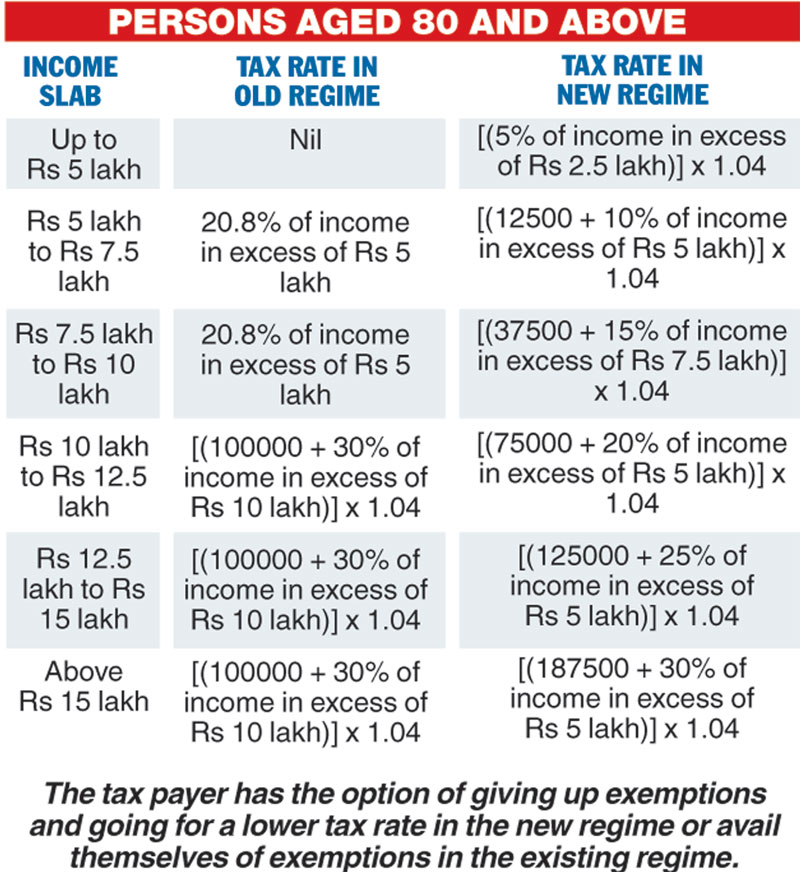

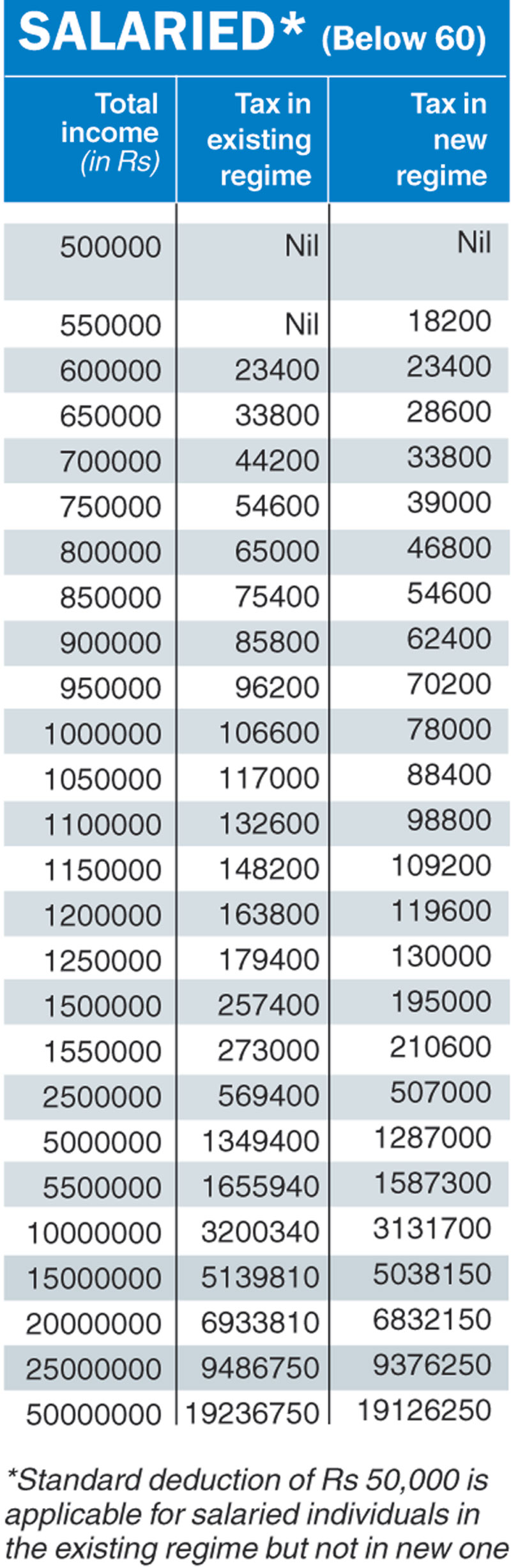

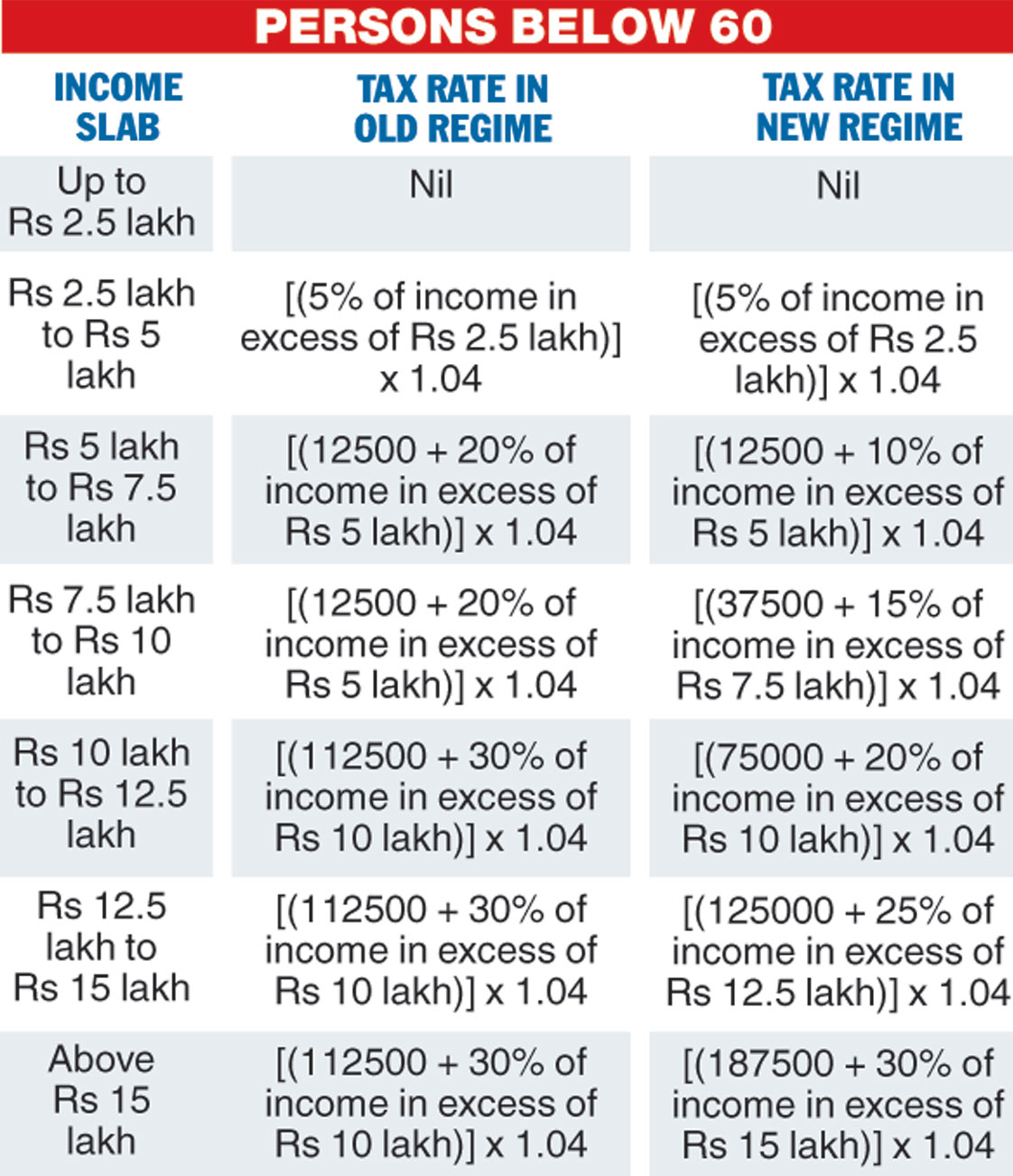

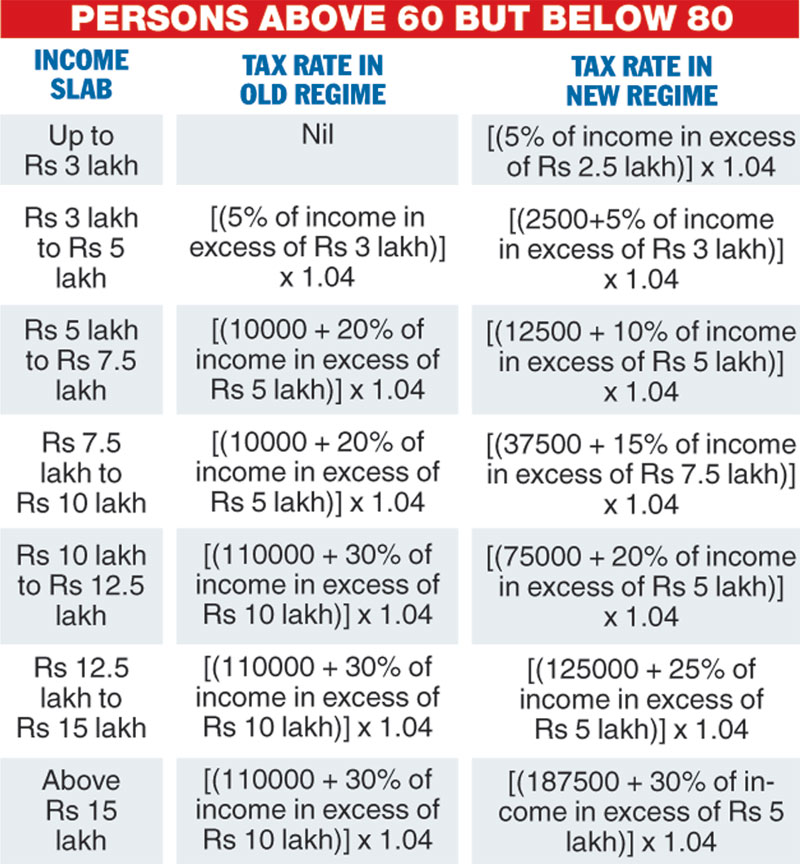

The finance ministry has introduced a new personal income tax regime with low tax rates through a new section 115BAC of the Income Tax Act.

The new regime has been made optional, which implies that the taxpayer can continue to remain in the current tax regime or migrate to the lower tax regime. But, there is a catch.

Individuals opting for the lower personal income tax regime will have to forego almost all tax breaks they were claiming in the current tax structure.

If you move to the new tax regime, you forego:

⚫ Standard Deduction of Rs 50000

⚫ Interest on home loan of Rs 2 lakh per annum

⚫ Expenditure incurred on payment of rent, transport and conveyance allowance, allowance of income of minor

⚫ Investments under section 80C (insurance, provident fund, ELSS home loan principal, ulip, SCSS etc), 80D (mediclaim) etc

⚫ Tax benefits under section 80DD/80DDB

⚫ Interest from savings bank or post office savings account of Rs 10000 under 80TTA or Rs 50,000 for senior citizens under section 80TTB

⚫ Donation under 80G

⚫ Deduction of rent upto Rs 5000 under 80GG

A total of 70 exemptions are removed under the simplified tax regime.

However, tax breaks on contributions on notified pension schemes of LIC or NPS etc continues to remain exempt.

For individuals who are running a PPF account or making contributions to their life insurance schemes, it would make sense to continue with the old tax regime as long as these recurring investments continue.

Moreover, if any individual is looking to buy a new house and take finance option, there is no benefit under the new income tax regime.

So, it is primarily individuals who are at the early stage of their carrier, who are unable to exhaust the income tax exemptions, stand to benefit from the new lower income tax regime.

(Pinak Ghosh)

The Telegraph

Jayadyoti Choudhuri Telegraph picture

The Telegraph

Will think twice before buying a home

Mousumi (29) and Arindam Ghosh (30) tied the knot in November 2019. Arindam is a banker, while Mousumi is into operations management. She was posted in Odisha before her wedding. The couple invests in life insurance, PPF and in mutual fund SIPs. Arindam and Mousumi want to soon buy a home of their own but feel the tax exemptions under 80C and 24B are too little compared to the huge EMIs one has to pay for even a two-BHK flat these days.

The process of applying for a loan is so complex and the processing charges and documentation fees are pretty high. The couple wants the government to make home buying a simpler and affordable process so that more people like them are encouraged to buy a home instead of paying rent. These days, people think twice before applying for a loan. To continue to live on rent or not is a dilemma for most with transferable jobs.

Budget reaction

The budget is quite disappointing for people like us who were planning to take a home loan. In terms of slash in income tax rate there is a catch that if a individual wants to avail the new tax regime he can’t opt for exemption and if he wants exemption he has to go for old tax regime...ultimately it’s all the same.

They have retained the additional benefit of Rs 1.5 lakh on interest paid on home loans below Rs 45 lakh for another year. But wish the amount of eligible loan would have been more.

Tax calculation has become very complex

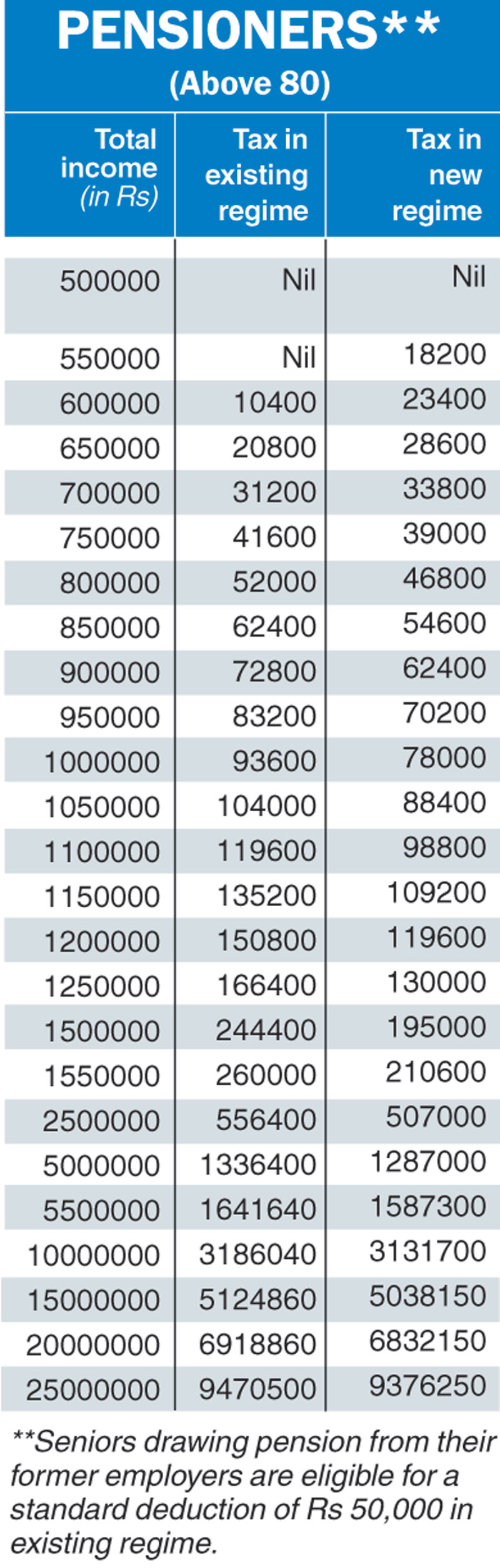

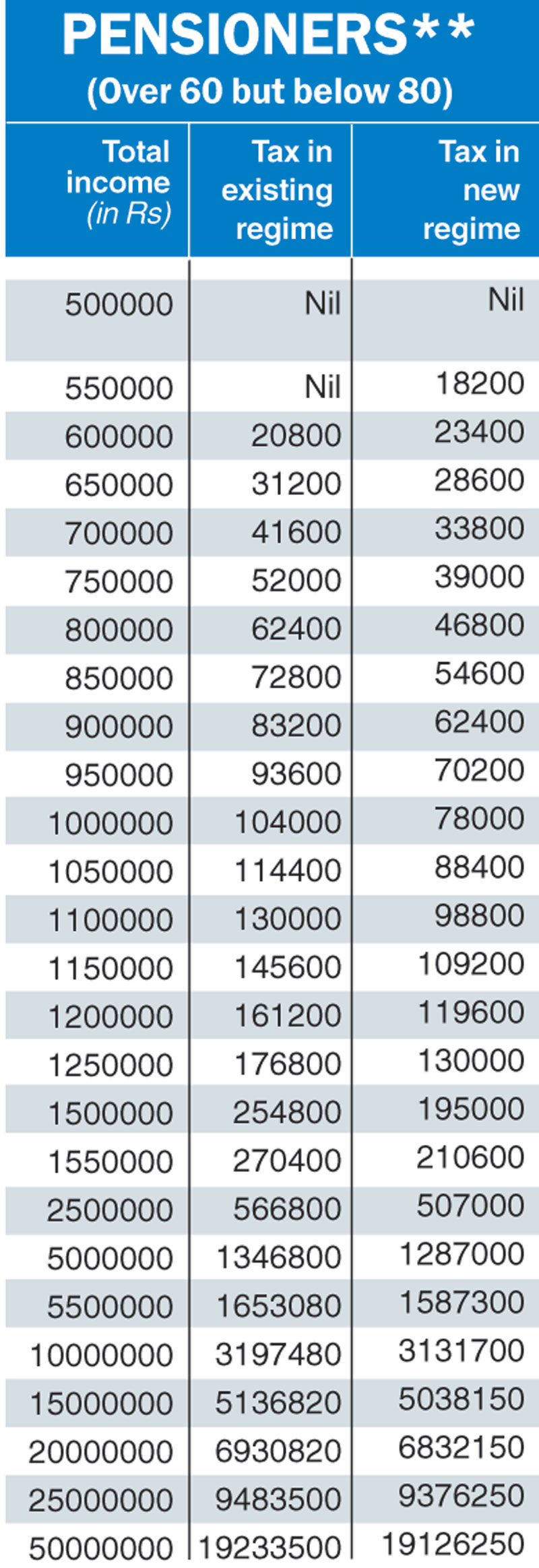

Jayadyoti Choudhuri (71) is a retired school teacher who lives in Calcutta with her husband. She saves tax by investing in PPF and medical insurance policies.

Jayadyoti feels that given the rising costs of health services, the tax break on mediclaim contributions by senior citizens should be way more than the current limits.

The monthly expenditure on medicines is a big part of the household budget. She feels the amount a senior citizen spends on medicines and investigations on a regular basis should be eligible for deduction. In a falling interest rate regime, where seniors like her have very few avenues to make their money grow, the minimum the government can do is offer them more tax benefits.

Jayadyoti would like to travel abroad to meet her daughter, but with rising travel expenses, health insurance, visa costs, and new tax laws, it is becoming prohibitive. She feels elders should have more disposable income after meeting rising food and health costs to be able to lead independent lives without being a burden on their children.

Budget reaction

Without deductions, the tax calculation has become more complicated with so many different slabs. With deductions the tax structure has not changed. However, retired people who don’t avail of deductions may be benefited. Now, which system is better for retired persons as a whole remains to be seen. There are ideas which are innovative and foreign investment in India should increase. The government is trying hard to bring honesty in the system.

What about social security?

Sunandita dey (45) is a trainer for children’s skill development programmes. She invests in tax saving mutual funds that offer her benefits under Section 80C of the I-T Act.

As an average tax paying individual, she wants the government to provide her with a bigger savings window. She needs more money in her hands as this will let her save more in the long run and plan adequately for her retirement. She wants the government to encourage her enough to direct more savings towards the stock market. The latter, she is convinced, is the smartest choice for her, despite the risks involved.

She also hopes the authorities will prompt insurers to offer better choices, especially for health insurance.

Budget reaction

I am satisfied with the budget because the FM has displayed some empathy for the working middle class. I liked the way the budget has rationalised the income tax structure; I think the average tax payer in the country will gain from it. I am happy to see her acknowledge the contribution of “new economy”. However, the government could have done a lot better on two important issues... health insurance and pension. I wish to ask our FM: couldn’t you have spared some thought on millions who have little or no health insurance? Or practically no social security?

Nothing to write home about

Saheli kar (25) is a software engineer working for a multinational company. She lives in Calcutta with her retired parents and a younger brother.

Saheli regularly keeps a big chunk of her salary in voluntary PF that her company allows. She would love to invest in the market but wants to first get the hang of it.

Saheli hopes the budget reduces the tax rates so that she can have more in her hands to spend on travel and books. She also wishes education loans were cheaper so that her brother can achieve his career goals.

Increased tax deductions towards healthcare and home loans can be a great help, she feels.

“India spends very little on healthcare. We need more medical colleges,” she says.

On the macro level, she feels education both primary and in higher research should be the focus of the government. Investment in good roads, bridges, metro travel is high on Saheli’s wish list.

Some encouragement for those interested in sports would be most welcome.

Budget reaction

The budget has lowered the tax rates raising disposable income, but I am not entirely happy. How can the government consider sale of shares of LIC? This will not give confidence to the common person in investing in life insurance policies. Moreover, there is no exemption if I invest in insurance policies. So where is the incentive? The government should have focussed more on raising interest rates further in the interest of investors. There is no tax liability for income up to Rs 5 lakh. But I don’t think the government has done enough for the common man. I also have senior citizens in family and there is hardly any additional benefit for them.

No direct guideline... a shallow budget

Arpan saha (25) is a software engineer working for an MNC. He invests in PPF and mediclaim to get tax breaks. Arpan feels the middle class needs a boost in this budget. There is a significant tax outgo for an individual earning between Rs 5 lakh and Rs 10 lakh. A cut in the tax rate will increase the disposable income in the hands of the middle class taxpayer and provide the required boost to the economy.

The Rs 1.5 lakh limit under section 80C can be raised to help boost public savings. Corporate bonds by top-rated PSUs should be encouraged too. The government is dealing with a tight fiscal situation with lower than expected tax collections and selloff proceeds. So the magic word this budget should be higher disposable income in the hands of individuals.

Budget reaction

Budget 2020 has offered tax payers the option to choose between the existing income tax regime and a new regime with slashed income tax rates and new income slabs but no tax exemptions. But which tax regime will lower my tax payable will depend on my income composition and investments. For someone who has bought a long term life insurance he/she will not be able to switch to the new regime, while in the old regime also the FM has disallowed 70 exceptions.

In the new regime, some of the deductions that have been proposed to be removed include standard deduction and house rent allowance, which most of us take benefit of.

As dividends become taxable in your hands, your taxable income will increase. However, increasing depositor insurance to Rs 5 lakh from the current Rs 1 lakh is a positive move to secure the public’s money.

The farm and rural sectors were allocated Rs 2.83 trillion, while the agriculture credit target for next year is set at Rs 15 trillion. This is a positive move to give the rural sectors hope to sustain. However, there is no direct guideline to boost the economy. There is no particular project to decrease unemployment. On a whole it’s a shallow budget.

Will wait and watch to see the results

Abhirup Nandy (36) is a first-generation entrepreneur in the business of beauty and grooming. Abhirup feels a salon is a great model to understand the demand situation in the economy as hair and skin maintenance services are self-regulatory. He has observed that even festivals have not encouraged people to increase their spends on such services.

GST on salon services is pretty high at 18 per cent while premium restaurants charge only a 5 per cent GST. A tax of Rs 89 on a basic hair cut of Rs 495 is a bit steep, he feels.

Abhirup feels the grooming industry is fuelled by skill development and they need more academies to train stylists. Tax breaks on loans taken to set up such skill development institutes will encourage entrepreneurs like him to diversify into training and also offer more vocational options to young people who want to work in this field. The entire Northeast region has a huge potential to harness this skill. “Last, but not the least, we pay such high taxes but breathing healthy air and enjoying a smooth ride to work is a luxury now!”

Budget reaction

More disposable income in the hands of my younger clients means more business for me. But hardly any incentive for private sector players like me to diversify into skill training. The tax changes are very confusing. I will have to wait and watch and calculate to decide what is best for me as far as my personal tax is concerned. Just wish the tax authorities are more transparent when it comes to assessment of both direct and indirect tax