Singapore Telecommunications (Singtel) on Thursday said it had sold a 0.8 per cent stake in Bharti Airtel for Singapore $950 million ($711 million) to Rajiv Jain-led GQG Partners.

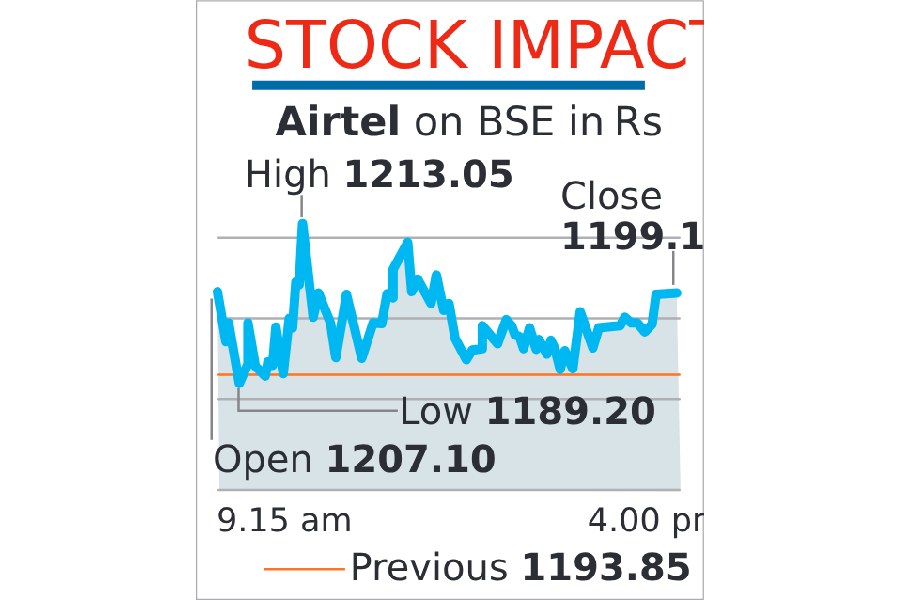

Data from the NSE showed a block deal of 4.90 crore shares worth Rs 5,849.13 crore. Singtel’s effective stake in the telco will now come down to 29 per cent from 29.8 per cent.

In 2022, Singtel sold 3.3 per cent of Bharti Airtel for S$ 2.54 billion, or almost $2 billion.

Singtel said that the stake sale is part of a ``capital recycling” effort to unlock value from its assets, bringing the total capital recycled to S$ 8 billion since 2021.

According to the group, this has allowed it to fund the growth of its data centre and IT services as well as reduce net debt by S$3.2 billion by September.

The group added that it has also returned S$0.8 billion in special dividends to shareholders from capital recycling, contributing to cumulative dividends of S$5.2 billion paid out to shareholders since April 2022.

“We’re pleased to have raised S$0.95 billion while adding a marquee name to Airtel’s share base. The group is now in an even stronger position to execute our disciplined capital approach of balancing investing for greater growth and delivering strong, sustainable returns for our shareholders,’’ Arthur Lang, Singtel Group CFO said.

Lang added that Airtel continues to see steady growth across all its businesses and has been rewarded with strong market valuations. “We intend to stay invested for the long-term while working with Bharti Enterprises to equalise our effective stake in Airtel over time.”

While GQG Capital Partners made headlines for its bold investment in the Adani group after the Hindenburg report, it has subsequently bet on other Indian companies.

For instance, Macrotech Developers earlier known as Lodha Developers has raised Rs 3,281 crore through share sale to institutional investors that included Invesco Developing Markets Fund and GQG Partners.