The shares of Reliance Industries Ltd (RIL) on Monday hit a 52-week high during intra-day trades and its market cap rose Rs 67,326 crore — following its twin announcements last week to reduce the equity capital held by the shareholders of Reliance Retail and separately list its financial services business.

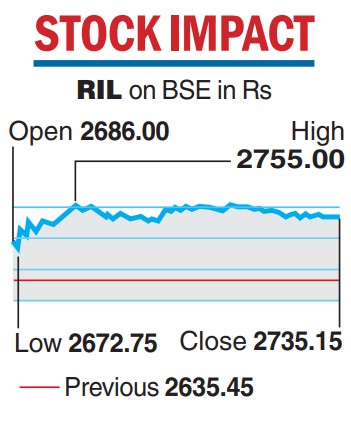

Reliance rallied 3.78 per cent to end at Rs 2,735.15 on the BSE after vaulting 4.53 per cent to hit a 52-week high of Rs 2,755. It climbed 3.85 per cent to end at Rs 2,735.25 on the NSE. RIL was the top gainer in both the Sensex and Nifty.

In traded volume terms, 11.11 lakh shares of the company were traded on the BSE and over 1.53 crore shares on the NSE during the day. The market capitalisation stood at Rs 18.5 lakh crore.

The strong buying interest came after the company announced its plan to demerge its financial services undertaking into Reliance Strategic Investments Ltd (RSIL), rename it Jio Financial Services Ltd (JFSL) and list the new entity on the bourses.

Under the arrangement, Reliance shareholders will get shares of JFSL in a 1:1 ratio as of the record date of July 20.

Investors also took note of the decision to reduce the equity capital of Reliance Retail to the extent held by the minority shareholders which led to expectations of listing of the retail business as well.

While the two independent valuers said the retail business was worth $92-96 billion, some brokerages said it was much higher at over $100 billion.

Reliance Retail is an arm of Reliance Retail Ventures Ltd (RRVL) which in turn is a subsidiary of RIL.

Marquee investors

RIL had earlier sold a 10.09 per cent stake in RRVL to overseas investors such as Silver Lake, KKR, Mubadala and Abu Dhabi Investment Authority for Rs 47,265 crore.

Speculation is now growing whether the share reduction will be followed by Reliance buying out the overseas investors as well. Observers said while RIL has not announced any such plans, these investors can offload their shares should value unlocking take place through an IPO.

Analysts at JP Morgan valued RIL’s retail business, comprising RRVL and Reliance Retail, at an EV of $112 billion based on FY24 financials.

“While RIL does not give out entity-wide debt details, the FY22 annual report of RRL implied a net debt of Rs 40,000 crore (around $5bn) and we believe this would have likely increased in FY23 given multiple acquisitions and capex incurred by the retail business in FY23,” the analysts said.

“Assuming a net debt of around $12bn at Retail, implied equity value stands at $100bn. This is closer to the $92bn-$96bn valuation by the valuers of RRL, and does not take into account the logistics and warehousing services provided by RRVL.’’