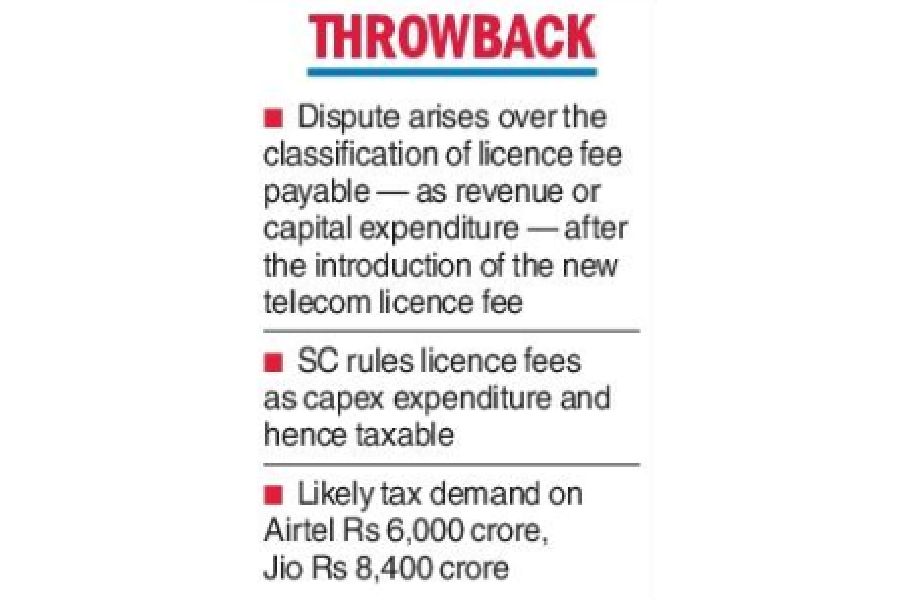

Telecom companies will suffer a massive tax blow after a Supreme Court ruling that classifies a telecom licence fee as capital expenditure and not revenue expenditure — in effect upholding the argument put forth by the tax authorities while disallowing the huge tax deduction the telcos have been seeking on their legacy dues.

Airtel and Reliance Jio can face a tax demand of about Rs 6,000 crore and Rs 8,400 crore, respectively, for the 2020-23 period following the Supreme Court order holding the licence fee paid by telecom operators to be “capital in nature”, Kotak Institutional Equities estimates.

The likely tax demand on Vodafone Idea, which is already facing a massive tax demand on legacy dues, would challenge its existence and could lead to a duopoly.

The Supreme Court ruled that telecom licence fees should be treated as entirely “capital in nature”, rejecting the previous Delhi High Court decision that classified them as both revenue and capital.

Analysts said with the apex court’s judgment, telcos would now have to look at tax records (starting from 1999) and make the necessary payments. The telcos are likely to appeal against the order.

“The judgment will create precedence for future legislations,” said Soumyadip Roychoudhury of BDO India.

Earlier Delhi High Court had held the expenditure cannot be construed as capital expenditure since the licence fee is paid as a part of the revenue as per the AGR scheme.

Under an amended Section 35ABB of the Income tax — which is the taxing clause relating specifically to telecom licence fees – a deduction “equal to appropriate fraction of the amount of such expenditure” is permitted.

The specific case involved Bharti Hexacomm. After the new telecom policy of 1999 was introduced, telecom companies opted out of the one-time licence fee and switched to a licence fee linked to AGR.

Hexacomm filed its nil return on the basis that it was required to pay a licence fee of Rs 11.88 crore which it claimed was revenue expenditure and therefore fully tax deductible.

The taxman challenged this view — arguing that the licence still had 12 years to run. Therefore, the “appropriate fraction” under section 35ABB would be 1/12th of the sum, which means that the deduction permitted would be only Rs 99.06 lakh. The remaining amount of Rs 10.89 crore would be treated as income and taxed accordingly.