The decision to remove the additional surcharge on foreign portfolio investors, along with other measures to revive a flagging economy, catapulted the Sensex by 793 points on Monday — its best show in over three months. Positive developments on the US-China trade front also contributed to the rally.

On Friday, finance minister Nirmala Sitharaman had announced several measures, which included the rollback of the higher surcharge on FPIs, apart from steps such as an upfront infusion of Rs 70,000 crore in public sector banks.

Analysts had expected the markets to react positively to these boosters but also feared volatility as the trade hostilities between the US and China had worsened over the weekend before Monday’s peace manoeuvres.

The Sensex began on a strong note at 37363.95 — a gain of over 662 points but slumped to the day’s low of 36492.65 — thus wiping out most of the gains. However, the stocks resumed their upward climb after Trump announced the resumption of talks with China.

The gauge ended the day at 37494.12 — a gain of 792.96 points, or 2.16 per cent.

Similarly, the broader NSE Nifty reclaimed the 11,000-level. During the day, it climbed to a peak of 11070.30 and touched a low of 10756.55.

Monday’s rally saw investor wealth rising Rs 2.41 lakh crore. The market capitalisation of BSE-listed companies jumped to Rs 1,40,34,462.19 crore at the close of trade.

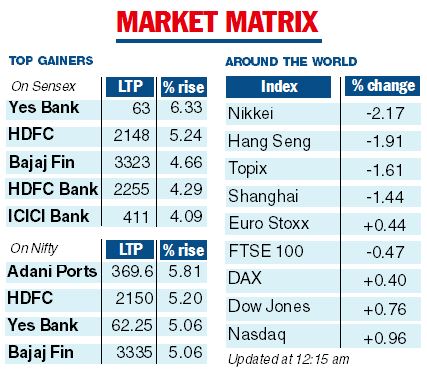

Banking, finance, realty and capital goods stocks led the gains; from the Sensex pack, 22 closed the day with gains led by Yes Bank, HDFC, Bajaj Finance and HDFC Bank.

On the other hand, Tata Steel, Sun Pharma, Hero MotoCorp, Vedanta, RIL, Tata Motors, Maruti Suzuki and Bajaj Auto fell up to 2.01 per cent.

On the BSE, 1,705 stocks advanced, while 811 declined and 123 remained unchanged.

Reacting to the measures announced by Sitharaman, brokerages said it would lift the sentiment, particularly ahead of the festival season.

“The finance minister’s announcements to boost growth will serve well to improve sentiments,” a note from Motilal Oswal Financial Services said.

“More importantly, the government’s intention and willingness to take feedback and act promptly may offset the pessimistic market narrative. Timing-wise, it has come just ahead of the beginning of a long festival season and may boost consumer sentiment. Expectations of more measures over the next two weeks will likely drive a short-term bounce after the sharp correction post budget,’’ the note said.

Bond rally

Bond prices also witnessed a rally as the markets were relieved that Sitharaman did not offer any major stimulus which would have seen the Centre borrowing more.

Yields on the benchmark 10-year security settled at 6.48 per cent against the previous close of 6.57 per cent.