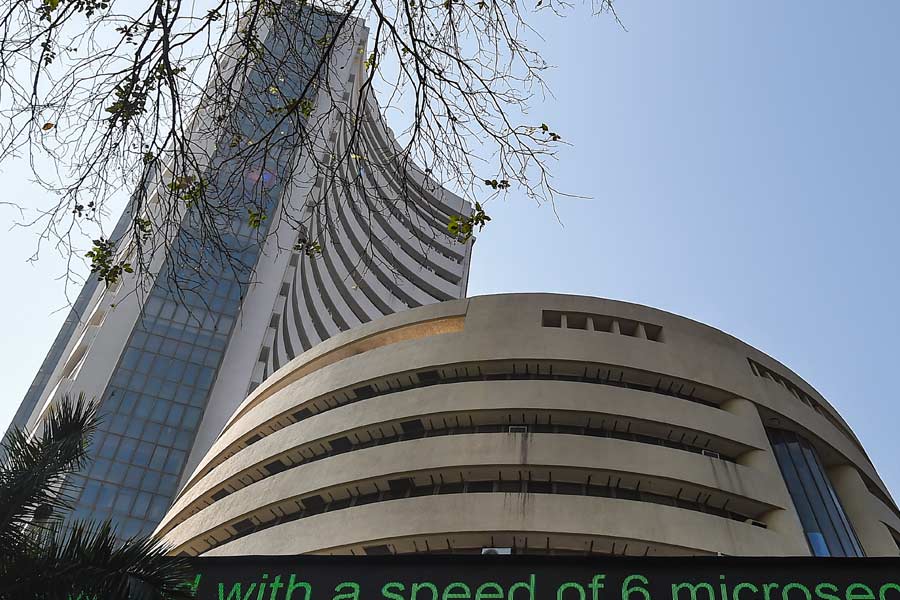

The Sensex plunged more than 1190 points on Thursday to close below the 80000 mark on worries over the pace of rate cuts in the US after an inflation gauge that is tracked by the Fed ticked higher in October.

Apprehensions over policies that could be adopted by the incoming US President Donald Trump amid resumption in selling by FPIs and monthly F&O expiry also weighed on stocks. Provisional data showed foreign portfolio investors (FPIs) selling shares worth ₹11,756 crore on Thursday.

The 30-share Sensex tanked 1190.34 points, or 1.48 per cent, to end at 79043.74. During the day, it collapsed 1315.16 points, or 1.63 per cent, to 78918.92. The NSE Nifty tumbled 360.75 points, or 1.49 per cent, to 23914.15.

Investors were spooked by the rise in US personal consumption inflation to 2.3 per cent in October from 2.1 per cent in the preceding month.

Though the index was in line with Dow Jones consensus forecast, the higher number led to fears that the Fed could slow down the pace of interest rate cuts. The FOMC will hold its last meeting for this calendar year on December 17-18. IT stocks witnessed heavy selling pressure due to concerns that discretionary spending could be affected if the Fed goes slow on lowering borrowing costs.

“Domestic markets took a breather after a strong start to the week. The overnight sell-off in the US market, driven by renewed uncertainty about the rate cut trajectory and rising geopolitical tension, led to a correction in heavyweight IT and consumer discretionary stocks,” Vinod Nair, head of research, Geojit Financial Services, said.

In the broader market, the BSE smallcap index climbed 0.41 per cent, while the midcap index dipped 0.06 per cent.

“The Nifty closed sharply lower at 23914, down 1.49 per cent, weighed by monthly F&O expiry and weak global cues. Escalation in the Russia-Ukraine conflict and uncertainties over the US interest rate trajectory post mixed economic data releases dented sentiment,” Siddhartha Khemka of Motilal Oswal Financial Services Ltd said.

Meanwhile, the Reserve Bank of India (RBI) is set to hold interest rates on December 6 as a sharp rise in consumer inflation has led several economists in a Reuters poll to push back their forecasts for the first cut in the cycle by a couple of months to February.

Annual retail inflation surged past the RBI’s 6 per cent tolerance ceiling in October, driven by soaring food prices.

Weak rupee

At the forex markets, the rupee ended weak against the dollar on account of FPI sales in the equity markets and demand for the greenback from oil importers. The domestic currency ended at 84.49 against the dollar against its previous close of 84.45 to the US unit.

Last week, the rupee had hit an all-time low of 84.50. Forex circles said the rupee could have fallen more had it not been for an intervention from the RBI.

The RBI has been consistently selling dollars in the markets over the past several weeks to ensure that the rupee does not witness a material fall against the US which has been on an upswing after Trump was elected as US president.

Korea lowers rates

South Korea’s central bank on Thursday lowered its key policy rate for the second straight month and said the country’s economy will grow at a slower pace than it initially anticipated, reports AP.

Following a meeting of its monetary policymakers, the Bank of Korea cut its benchmark interest rate by a quarter percentage point to 3 per cent.

The bank lowered its outlook for the country’s economic growth from 2.4 per cent to 2.2 per cent for 2024 and from 2.1 per cent to 1.9 per cent for 2025.

With inputs from Reuters and AP