Frontline indices on Thursday slumped more than 2.60 per cent following a global rout on fears of looming stagflation in the US amid persistent selling by foreign portfolio investors (FPIs) in India. While the Sensex fell 1416.30 points, the NSE Nifty tanked 430.90 points.

The broad-based selling in the stock markets saw investor wealth falling over Rs 6.71 trillion as analysts warned of more pain on account of the combination of firm inflation, rising interest rates and a slowdown in global economic growth.

On Wednesday, the Dow Jones Industrial Average had tanked over 1,100 points in its biggest decline after 2020 on concerns related to economic growth. While global indices fell up to 2.54 per cent on Thursday, the Dow Jones Futures indicated a weak start to trade.

In India, minutes of the monetary policy committee (MPC) held earlier this month showed the Reserve Bank of India (RBI) to continue policy tightening by again raising the policy repo rate next month.

This comes even as the risk-off behaviour among foreign investors saw them continuing to dump stocks. Provisional data showed them selling shares worth Rs 4,900 crore on Thursday.

The 30-share BSE Sensex opened at 53070.30 and crashed 1539 points to the day’s low of 52669.51.

The bellwether subsequently ended at 52792.23, showing a fall of 1416.30 points or 2.61 per cent.

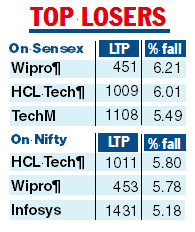

The Nifty 50 crashed 2.65 per cent to end at 15809.40. Barring ITC, Dr Reddy’s and PowerGrid which rose up to 3.43 per cent, the rest of the Sensex pack ended with losses of up to 6.21 per cent.

“Indian equities witnessed a sharp selloff on the back of weak global cues. Rising inflationary pressure, continuous FII selling and rupee depreciating to an all-time low have turned investors pessimistic in the near term,’’ Siddhartha Khemka, head — retail research, Motilal Oswal Financial Services, said.

Arun Malhotra, founding partner and portfolio manager at CapGrow Capital Advisors, said that while the global cues are quite negative, the continuous FII selling is putting pressure on the markets.

Moreover, though domestic institutions and retail investors are buying in the markets, their level of purchases have been declining.

“The long-term investors should focus on the large caps since a lot of value has emerged because the prices have been coming down, while the results and outlook have been strong. Volatility is the best friend for long-term investors,’’ he added.

IT worries

Soaring inflation, supply chain issues and the hit from the Ukraine war will bring an end to the growth boom India's IT services industry enjoyed during the pandemic, JPMorgan analysts said on Thursday as they downgraded the sector to “underweight”.

The $194-billion sector whose software services helped businesses adopt to pandemic-era practices of online shopping and remote working is facing a demand slowdown this year as employees return to offices and the Russia-Ukraine war weighs on spending from clients in Europe.

“We see peak revenue growth behind us and EBIT margins trending down from inflation, mean reversion,” JPM said.

With inputs from Reuters