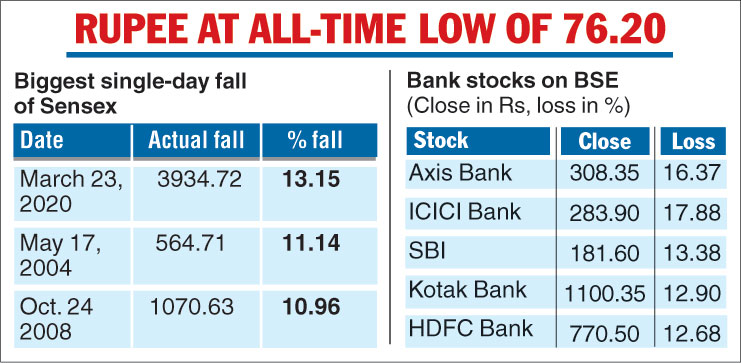

The stock markets suffered their worst ever single-day crash on Monday, with the benchmark indices plunging as much as 13.15 per cent, as panicked investors remained in a selloff mode amid lockdowns in several states in the country because of mounting coronavirus cases.

The BSE benchmark Sensex plummetted 3935 points, or 13. 15 per cent, to close at 25981.24, while the NSE barometer Nifty cracked 1135.20 points, or 12.98 per cent, to settle at 7610.25.

On the currency front, the rupee plunged below the 76-level (intra-day) for the first time.

In the very first hour of trade on Monday, trading on the BSE and the NSE had to be halted after the benchmark indices — Sensex and Nifty — hit the 10 per cent lower circuit breaker. As trading resumed after a 45-minute freeze, losses widened because of unabated sell-offs across sectors.

Global stocks were also roiled after nations across the world announced lockdowns in an effort to mitigate the spread of the Covid-19 pandemic, spiking fears of a mammoth global recession.

On the Sensex chart, Axis Bank was the top loser, tanking over 28 per cent intra-day, followed by Bajaj Finance, IndusInd Bank, ICICI Bank, Maruti and L&T.

Monday’s crash wiped out Rs 14 lakh crore of investor wealth.

All sectoral indices ended significantly lower, with the BSE bankex, finance, capital goods, basic materials, industrials and auto indices plunging up to 16.82 per cent. The broader midcap and smallcap indices tanked over 12 per cent each.

As expected in such circumstances, the rupee came under intense pressure and it slipped below the 76 mark for the first time in its history. The currency fell 100 paise to settle at a lifetime low of 76.20 against the dollar because of heavy dollar demand amid the crash in the stock markets.

Forex circles blamed its fall on continued sales by foreign portfolio investors (FPIs) and a global dollar rally as investors dumped riskier assets in favour of the US currency.

The rupee, which opened on a weak note at 75.90 at the inter-bank forex market, sank to an all-time low of 76.30 following the deep losses in stock markets. The rupee finally settled at 76.20 against the dollar, registering a decline of 100 paise over its last close.

Provisional data from the NSE showed that FPIs sold around Rs 3,000 crore of stocks in Monday’s trade.

“The steep correction because of the coronavirus impact has made many good stocks cheaper and attractive. The best strategy for long term investors would be to accumulate good fundamental and quality stocks gradually over the next few weeks and months,” Siddhartha Khemka, head retail research, Motilal Oswal Financial Services Pvt Ltd, said.

“While it is very difficult to predict the bottom of the market, it always rewards investors in the long term who take the benefit of such a sharp fall. Markets may continue to fall in near term, and that’s the time to start becoming greedy,” Khemka said.

The 30-share Sensex began the week sharply lower at 27608.80 compared with the previous close of 29915.96 and hit 26924.11 in the first hour leading to the trading session being suspended for 45 minutes. There was no relief after trading resumed as investors continued to press sales.

Meanwhile, S&P Global Ratings on Monday cut its estimate for India’s GDP growth for the next fiscal to 5.2 per cent from its earlier estimate of 6.5 per cent, which further worsened the market sentiment that has been already reeling under the coronavirus spread. Meanwhile, Brent crude oil futures dropped 5.30 per cent to $25.55 per barrel.