Stocks and the rupee are taking divergent paths in New Year: while the Sensex soared 1,436 points on Thursday, the rupee closed at another record low of 85.7525 against the dollar.

Investors chased financials and auto stocks after encouraging business updates which fuelled optimism over corporate India earnings even as FPI outflows and strong demand for the greenback from importers dragged down the rupee.

The Sensex had closed at 368 points on Thursday. The rupee had hit a record low of 85.65.

Expectations the Reserve Bank of India (RBI) would begin its interest rate easing cycle from next month added to the positive sentiment.

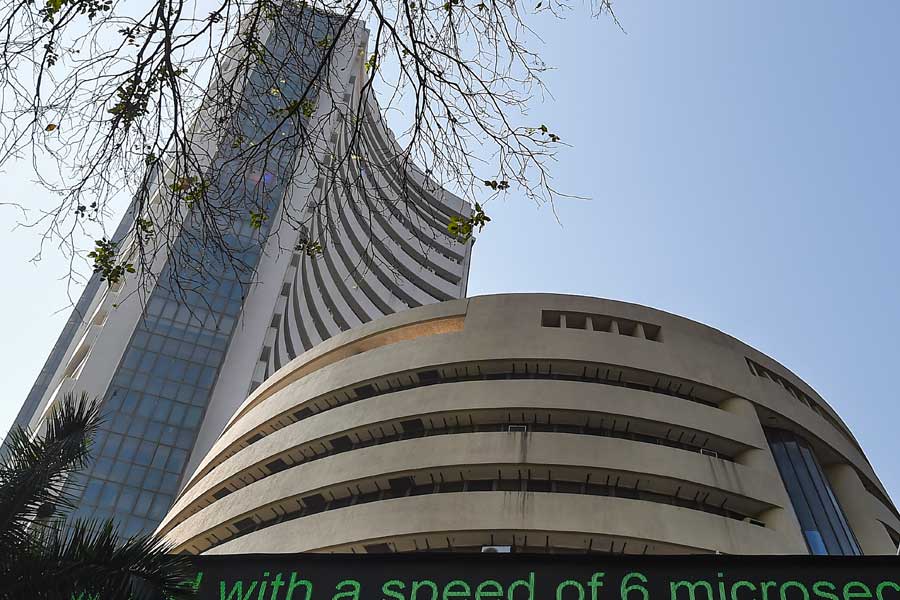

At Dalal Street, the 30-share Sensex rallied 1436.30 points or 1.83 per cent — its best single-day gain in more than a month — to end at 79943.71.

During intra-day trades, it jumped 1525.46 points to touch a high of 80032.87. Similarly, the Nifty surged 445.75 points to 24188.65.

Analysts said strong December sales numbers from most auto firms brought back the vim in the markets.

Investors also picked up stocks that were available at reasonable valuations after the recent bout of correction.

Record low

At the inter-bank forex market, the rupee settled at 85.7525 compared with its previous close of 85.64.

During intra-day trades, the rupee hit a low of 85.79, but recovered due to intervention from the Reserve Bank of India (RBI) through state-run banks.

“We expect the rupee to trade with a negative bias on strength in the US Dollar and dollar demand from importers. Sustained FII outflows may further pressure the rupee,” said Anuj Choudhary research analyst at Mirae Asset Sharekhan.