The Sensex on Friday zoomed 1181 points and hit a 52-week high riding on falling inflation data in the US — that may lead to the US Fed slowing down its pace of rate hikes, while diminishing the prospects of recession in the world’s largest economy.

A similar bullish trend was seen on the forex markets as the rupee scored a century by gaining 100 paise against the dollar to close at 80.81, the first time in recent months it has staged such a mammoth rise.

US inflation in October stood at 7.7 per cent which is lower than expectations of a print of 8-per-cent-plus, raising the possibility of the Fed limiting its rate hike to 50 basis points at its meeting next month.

“The lower retail inflation in the US essentially has reduced the recession probability to 40 per cent from 60 per cent and has brought down the expectation of a peak benchmark rate from 5.25 per cent to 5 per cent. This is the first spark of good news from the US in a long time and has been instrumental in lifting investor sentiments,’’ Sushant Bhansali, CEO, Ambit Asset Management said.

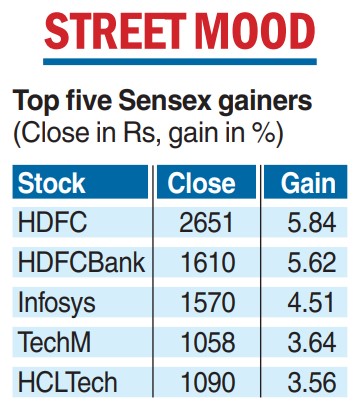

The 30-share gauge opened gap-up at 61311.02 and shot up 1227.27 points to hit a new 52-week high of 61840.97. It thereafter settled at 61795.04, a gain of 1181.34 points or 1.95 per cent.

The broader Nifty notched a 52-week peak of 18362.30, bursting through the key resistance level of 18300. It subsequently closed higher 321.50 points or 1.78 per cent at 18349.70.

After the inflation numbers were released, the S&P 500 jumped 5.5 per cent and the Nasdaq over 7 per cent. In Asia all the bourses were in green territory with the largest gain seen at Hang Seng which pole vaulted over 7.70 per cent.

Observers said that good corporate results and net inflows from foreign portfolio investors (FPIs) have kept equities in good stead.

“Though it is too early to predict, if the global volatility subsides and if the sentiment improves, India will receive a huge share of foreign institutional investments in addition to already strong domestic flows,” Devang Mehta, head — equity advisory, Centrum Wealth said.

Industry output rises 3.1%

New Delhi: The country’s industrial output expanded 3.1 per cent in September, but consumer durables reported a fall in this festive period, according to official data. The growth was primarily because of a rise in manufacturing and mining outputs.

The manufacturing sector grew 1.8 per cent in September, while the power sector grew 11.6 per cent. Mining sector witnessed a growth of 4.6 per cent.

“Industrial output trailed our estimate of 5.1 per cent amidst a YoY contraction in consumer goods and weak export demand,” Aditi Nayar, chief economist, Icra, said. The consumer durables segment declined 4.5 per cent from 1.6 per cent.

Madan Sabnavis, chief economist, Bank of Baroda said: “The fall in consumer durable and non-durables was not expected. Use of inventory appears to be chosen to meet sales. Even electronics component registered marginal negative growth which is a surprise.”

OUR SPECIAL CORRESPONDENT