The week ended on a dreadful note for the stock markets as the benchmark Sensex plunged over 1176 points and investor wealth eroded by ₹18.43 lakh crore on weak global cues emanating from the hawkish comments of the Federal Reserve and relentless FPI selling.

However, it was not a scary ending for the rupee thanks to the Reserve Bank of India (RBI).

The central bank’s interventions in the inter-bank forex market coupled to a softer Dollar Index (DXY which gauges the dollar’s strength against a basket of six other global units) saw the domestic currency recovering from a record low. The DXY was trading at 108 at the time of this report against its last close of 108.41.

The rupee settled at 85.01 compared with its previous close of 85.07. During the session, the unit had touched an historic intraday low of 85.10, but recouped the losses.

Though it was not a bad ending for the rupee, the story was different in the stock markets where participants continued to witness a selloff.

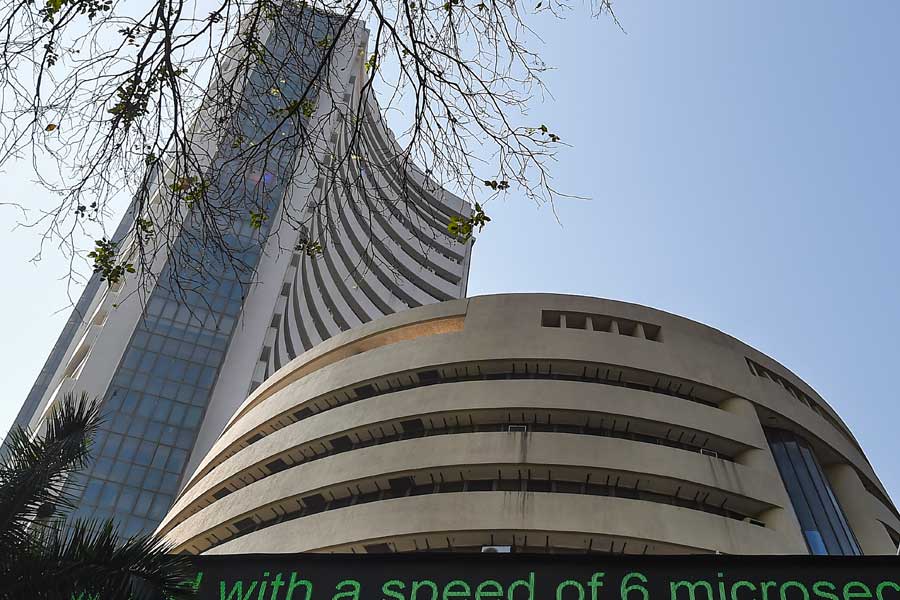

The 30-share BSE Sensex which opened slightly higher at 79335.48 was initially seen consolidating its position. However, the situation turned after noon that saw it crashing 1343.46 points to a day’s low of 77874.59. It thereafter sank below the 79000 mark to end at 78041.59, thus marking a fall of 1176.46 points or 1.49 per cent.

On the NSE, the Nifty tanked 364.20 points or 1.52 per cent to 23587.50.

Market experts said that this southbound trend was due to the hawkish commentary by the Fed which raised fears that it could lead to a cut in discretionary spending thereby affecting the Indian IT sector among others.

They added that buying is also not being witnessed at lower levels and that any gains are now sold into. FPIs continued to be in the sell mode and this was evident in the provisional data which showed them being net sellers to the tune of ₹3,598 crore.

With the third quarter results season around the corner, the apprehension is also that corporate India may report another set of disappointing results.

``Disappointment regarding the slower-than-anticipated rate cuts by the US Fed has adversely affected global market sentiment. This bearish outlook is particularly impacting the domestic market, which is already contending with high valuations and low earnings growth. The sell-off has been widespread, with significant declines in mid and small-cap stocks, where valuations premiumisation is at a historical peak,” Vinod Nair, head of research, Geojit Financial Services, said.

According to Osho Krishnan, senior analyst, technical & derivatives at Angel One, the Nifty50 experienced a significant decline, resembling a bottomless pit, as it breached all essential support levels.

RBI prop

Forex circles said the recovery of the rupee was on account of frequent dollar supplies at the behest of the RBI. The rupee opened at 85.07 and came under pressure due to weak stock prices.

Despite the gain in the rupee, experts said that the domestic currency will remain under pressure due to global factors and FPI (foreign portfolio investors) outflows from the equity markets.

This was reflected in the rupee trading at 85.33 in the offshore NDF (non-deliverable forward market) at one point of time. The NDF is an offshore over-the-counter market. It is a financial contract that enables participants to hedge on the future value of a currency.

Experts, however, feel that the DXY’s moderation could only be a blip.

``While today’s gains provided some relief, the broader trend remains bearish. The rupee’s weak trading range is projected between 84.85 and 85.15, with market participants closely watching global cues for further direction.” Jateen Trivedi, vice-president research analyst — commodity and currency, LKP Securities said.