Equity benchmark Sensex plummeted 1,407 points on Monday as panic over a new strain of coronavirus in the UK led to a massive selloff in global equities.

The 30-share BSE index plunged 1,406.73 points or 3 per cent to close at 45,553.96. The broader NSE Nifty crashed 432.15 points or 3.14 per cent to 13,328.40.

All Sensex components ended in the red, with ONGC leading the pack by tanking around 9 per cent. IndusInd Bank, M&M, SBI, NTPC, ITC, Axis Bank and PowerGrid shed up to 7 per cent.

"Domestic equities witnessed sharp selling pressure on Monday and wiped out more than Rs 7 trillion of investors' wealth in a single day," said Binod Modi, Head- Strategy at Reliance Securities.

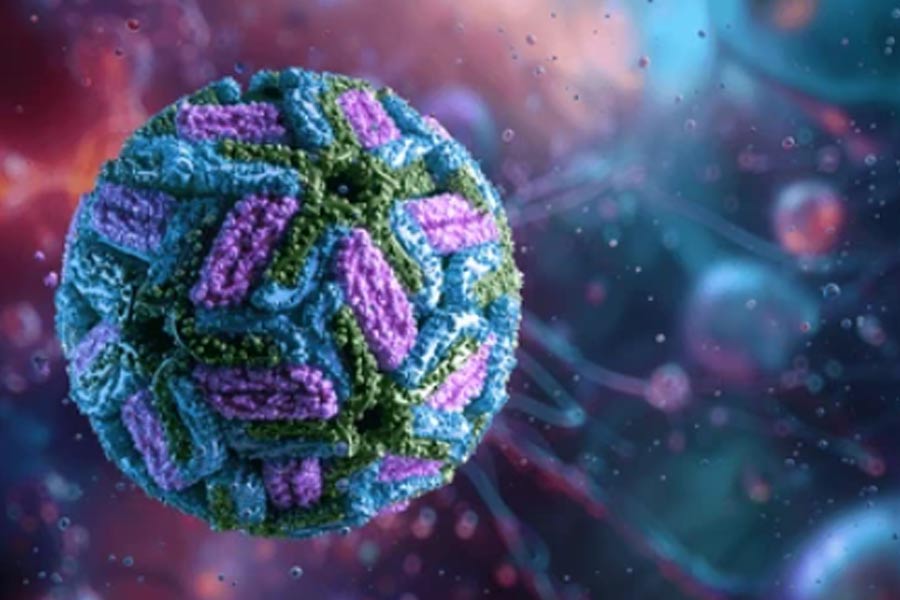

Concerns of new COVID-19 strain in the UK and emerging doubts over the efficacy of COVID-19 vaccination dented investors' sentiments globally, he said, adding that Indian market was among the worst performers as profit-booking also took place at higher levels.

Notably, the volatility index witnessed a sharp jump of 25 per cent, indicating more volatility ahead, he asserted.

Several European countries, including France, Germany, the Netherlands, Belgium, Austria and Italy, have banned flights from the UK with the British government warning that the potent new strain of the virus was "out of control". The UK has imposed a stringent new stay-at-home lockdown from Sunday in London and other regions.

India too has suspended all flights from the UK between December 23-31.

Stock exchanges in Paris, Frankfurt and London were trading up to 2.50 per lower in early deals.

Elsewhere in Asia, bourses in Hong Kong and Tokyo ended in the red, while Shanghai and Seoul settled with mild gains.

Global oil benchmark Brent crude futures plummeted 5.30 per cent to USD 49.49 per barrel.

Reliance Industries, ICICI Bank, HDFC Bank and HDFC were the biggest drags on Sensex. The four accounted for more than 500 points loss in the 30-scrip index.

Analysts say the rally in the domestic markets was driven by liquidity which is why any negative news warranted a deep correction.

"It is a bit too early to say anything, but there could be more of this healthy correction in the coming days. The markets are highly leveraged and lack of follow-up buying by foreign institutional investors ahead of Christmas holidays tripped the markets to fall off their own weight," AK Prabhakar, head of research at IDBI Capital Markets, told ndtv.com.

"However, investors will always be waiting to buy in a bull market; so any major correction can only happen after the Budget," he added.