Benchmark indices snapped a five-day rally and ended with losses of 1.20 per cent — weighed by a fresh outbreak of Covid-19 cases in several countries and an impending interest rate hike by the US Federal Reserve even as the Chinese central bank disappointed by keeping its medium-term policy rates unchanged.

The Sensex slumped 709.17 points to end at 55776.85 after plummeting more than 1067 points to 55418.95 during intra-day trades. The broader Nifty 50 crashed 208.30 points to settle at 16663.

Sentiment was affected by the rise in Covid-19 cases in countries such as the UK, France, Germany and Italy. The situation in China was also not good with reports saying almost three crore people were under lockdown.

There were other factors that contributed to the poor undertone: the US Federal Reserve after a two-day meeting is widely expected to announce a hike of 25 basis points in interest rates — the first since 2018 — on Wednesday to tame high inflation.

Analysts expect the Fed to raise rates 6-7 times this calendar year each by quarter of a percentage point.

The Indian retail inflation print of 6.07 per cent for February — an eight month high and above the RBI's comfort level — also hurt sentiment.

Foreign portfolio investors (FPIs) continue to remain net sellers.

In March, they have sold stocks worth almost Rs 41,600 crore after unloading Rs 69,000 crore cumulatively in the first two months of this calendar year.

“Global markets witnessed weakness as slew of events like the fourth round of sanctions against Russia, concerns about fresh cases of coronavirus in China and the expected US Fed interest rate hike which weighed on investor sentiments, although fall in a crude and metal prices capped the downside,” said Siddhartha Khemka, head - retail research, Motilal Oswal Financial Services .

“Nifty is now consolidating between 16600-16800 zones. While we have seen a strong rally in large caps, the broader market has not yet participated and is underperforming the Nifty. The US Fed meeting would be the key event this week which would drive the near term market direction.’’

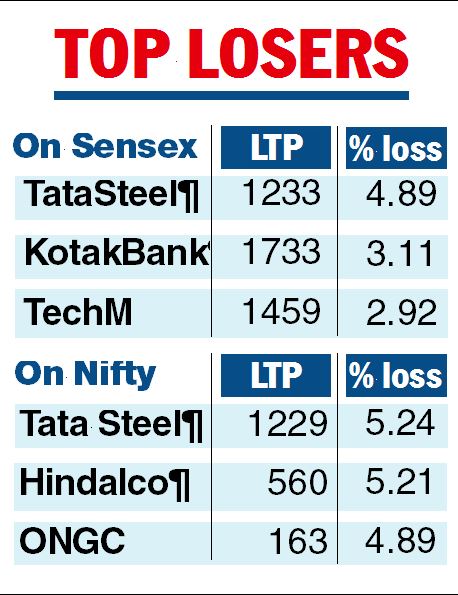

Tata Steel led the losers list in the Sensex pack falling 4.89 per cent. It was followed by Kotak Mahindra, Tech Mahindra, Infosys and Reliance.

Industries which fell upto 3.11 per cent. at the broader markets level while the Nifty mid-cap 100 index fell by almost one per cent, the Nifty small-cap 100 index cracked by 1.41 per cent.