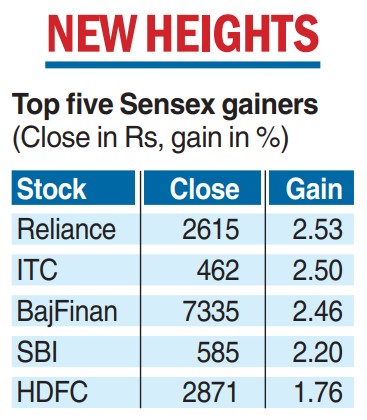

The Sensex on Monday crossed the 65000 mark for the first time as both benchmark indices continued to break records amid persistent inflows from foreign portfolio investors (FPIs) and positive global cues. The BSE bellwether jumped to 65000 from 64000 in just three trading sessions on Monday, pepped up by the merger of HDFC twins, with Reliance and ITC in tow.

The Sensex jumped 486.49 points to close at an all-time high of 65205.05, soaring to 65300.35 intra-day. The index breached the 64000 mark on June 28 in intra-day trading.

On the NSE, the 50-share Nifty hit a record high on all-round buying. The index climbed 133.50 points to 19322.55 at close, while reaching 19345.10 intra-day.

“The market’s record-breaking momentum continued as the robust June GST collections, and the monsoon covering most parts of the country in the last few days brought cheer to investors. The rally has been mostly due to strong foreign fund inflows. India performing well on most of the economic parameters could strengthen the fund flows in the near term,” said Shrikant Chouhan, head of research (retail), Kotak Securities.

In the Asian markets, Seoul, Tokyo, Shanghai and Hong Kong ended in the green, while bourses in Europe were trading in the positive territory, while the US markets ended significantly higher in overnight trade on Friday.

US investors took note of the personal consumption expenditure price index that came lower than expected, raising the possibility of the US Federal Reserve toning down its hawkish mood.

Analysts said the next round of triggers will be from the first quarter earnings season that will commence on July 12. They pointed out that with valuations emerging as a concern, any bad news will lead to a sharp correction.

“The overall structure of the market remains positive with Nifty attaining new highs at a steady pace. We expect PSU banks to remain in focus on the expectation of healthy first quarter 2023-24 numbers. With the monsoon deficiency reducing to 10 per cent, agri-related stocks are likely to be in focus,’’ Siddhartha Khemka, head — retail research, Motilal Oswal Financial Services, said.

GIFT Nifty

Singapore’s SGX Nifty commenced trading on a strong note as GIFT Nifty with an open interest of $8.05 billion in Nifty futures and over $1.05 billion open interest in Nifty options from SGX’s international client network.

The landmark change is expected to see derivatives contracts worth $7.5 billion, currently traded in Singapore, to migrate to India.

Besides, domestic investors and traders who always tracked the SGX Nifty to gauge the market opening will now have to track the GIFT Nifty.

Meanwhile, the BSE board will meet on July 6 to consider a proposal on the buyback of shares.