The benchmark index on Monday shed nearly 300 points on investor disappointment over the quarterly results of the companies.

Investors also refrained from buying as they awaited the outcome of the meeting of the US Fed on Wednesday.

Apart from RIL, the trio of ICICI Bank, Kotak Mahindra Bank and Yes Bank announced their quarterly results late last week.

After opening at 66629.14 and hitting a low of 66326.25, the Sensex fell 299.48 points or 0.45 per cent to settle at 66384.78.The broader NSE Nifty fell 72.65 points or 0.37 per cent to end at 19672.35.

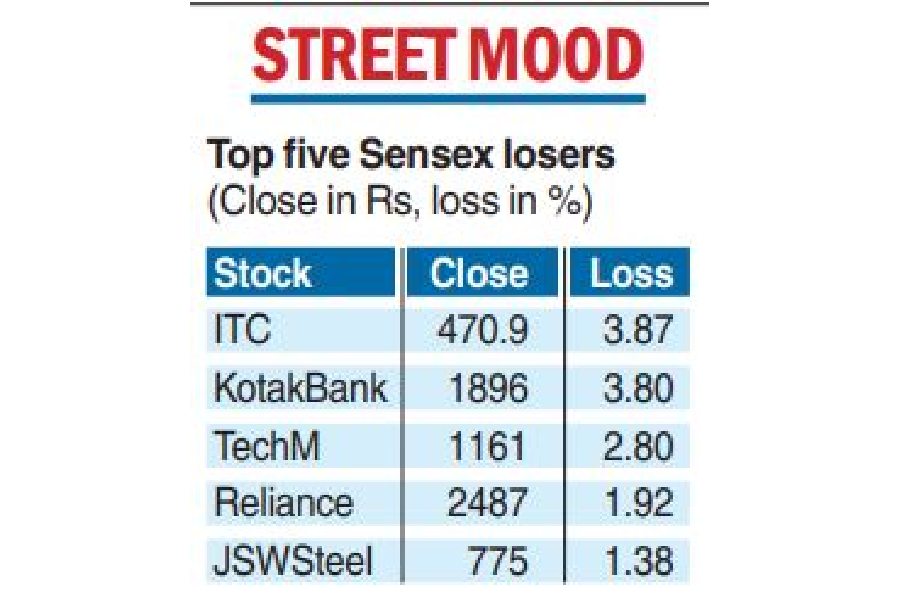

Shares of RIL declined 2 per cent on Monday after the conglomerate reported an 11 per cent drop in its June quarter net profit. The stock fell 2 per cent to close at Rs 2,488 apiece on the NSE. On the BSE, it declined 1.92 per cent to finish at Rs 2,487.55 apiece.

Kotak Mahindra Bank was also a laggard as it fell 3.80 per cent to Rs 1,896.15 on the BSE. Standalone provisions of the bank rose to Rs 364.31 crore from Rs 23.59 crore a year ago.

Meanwhile, the US Fed is widely expected to announce a 25 bps rate hike on Wednesday (July 26) after a two-day meeting. Asian equities also dropped ahead of the Fed and the European Central Bank monetary policy meetings.

The Telegraph

Vinod Nair, head of research, at Geojit Financial Services, said the market saw volatility as quarterly numbers announced by IT major and FMCG companies last week were below expectations.

“Sectorwise setbacks were seen in IT and FMCG, unveiling weak demand and high input costs. Banks are mixed while pharma stocks are withholding the volatility in anticipation of better demand from developed economies, reduction in US pricing issues, and expansion in operating margins.”