Growth worries and rising interest rates continued to spook investors for the third consecutive session, with the benchmark Sensex falling below the 60000 mark.

The 30-share BSE Sensex showed a crack of 452.90 points, or 0.75 per cent, to finish at 59900.37, after tanking over 684 points during intra-day trades to 59669.91.

The Nifty sunk 132.70 points, or 0.74 per cent, to close at 17859.45.

“Worries of global economic slowdown and higher interest rates prevailing going ahead triggered frenzied selling amongst investors that saw the Sensex end below the psychological level of 60000.

“The market is not comfortable with the current valuations given several headwinds, and hence investors resorted to profit-taking in banking, IT, and metals stocks,’’ Amol Athawale, deputy vice-president — technical research at Kotak Securities, said.

On a weekly basis, the Sensex lost 940.37 points, or 1.55 per cent, while the Nifty declined 245.85 points, or 1.36 per cent.

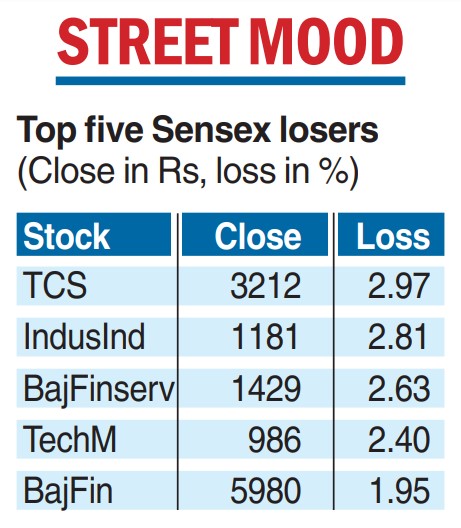

TCS was the top loser in the Sensex pack, shedding 2.97 per cent. Only five counters closed higher — Mahindra & Mahindra, Reliance Industries, Nestle India, ITC and Larsen & Toubro, rising up to 1.06 per cent.

In the broader market, while the BSE small-cap index fell 0.73 per cent, the mid-cap gauge declined 0.72 per cent.

Among sectoral indices, tech declined 1.86 per cent, IT dipped 1.77 per cent, metal 1.28 per cent, services 1.11 per cent, bankex 1.04 per cent and financial services 1.03 per cent.

In Asia, equity markets in Seoul, Tokyo and Shanghai ended in the green, while Hong Kong settled lower.

Market circles said that investors will now be looking out for the earnings season that will begin next week with technology firms declaring their quarterly numbers. Updates given by various firms ahead of these results have so far displayed a mixed trend, leading to some caution among investors.

According to Vinod Nair, head of research at Geojit Financial Services, the markets remain sensitive to FIIs selling and IT stocks traded with deep cuts ahead of the release of corporate earnings next week as the growth is anticipated to be muted.