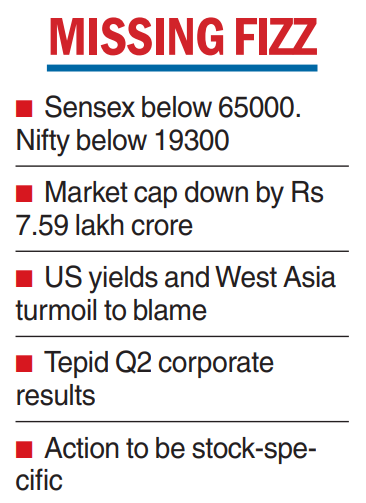

The festive spirit was missing in the stock markets as firm US treasury yields and heightened tensions in West Asia saw the benchmark Sensex crashing nearly 826 points to fall below the 65000 mark whereas the broader Nifty settled below 19300, even as investor wealth took a knock of Rs 7.59 lakh crore.

This selloff came as global stocks wilted after yields on the benchmark 10-year US treasury crossed five per cent to touch a high of 5.02 per cent. The uptrend was due to fears that the US Federal Reserve will keep interest rates at high levels for a longer period to control inflation.

While the 10-year yield was trading at 4.95 per cent at the time of writing this report, market circles said that stocks will continue to be driven by global factors with stock specific action being seen given the results calendar.

An added worry for investors is that the festival season has not yet shown any big fireworks. This comes even as there is no let-down in tensions in West Asia with Israeli warplanes reportedly striking certain targets in Gaza while the results season back home has been lacklustre.

The 30-share BSE Sensex which opened marginally higher at 65419.02 failed to keep the momentum as it plummeted 894.94 points or 1.36 per cent to an intra-day low of 64502.68 and subsequently shut shop at 64571.88, a drop of 825.74 points or 1.26 per cent.

At the NSE, the Nifty fell 260.90 points or 1.34 per cent to 19281.75. In the four sessions since Wednesday, the Sensex has tanked 1,925 points to fall below the 65,000 mark whereas the Nifty has tanked by around 530 points.

``Domestic equities came under pressure amid global turmoil and witnessed broad base selling. Fear of regional conflict in West Asia and worries over more rate hikes by US Fed for extended period were the major cause of concern in the market. Even the earning season has been mixed so far, thus not providing resilience to the market,” according to Siddhartha Khemka, Head — retail research, Motilal Oswal Financial Services, said.

“We expect the market to remain volatile amid rise in global uncertainties while the stock specific action is likely to continue in the market amid busy results season.”

“Investors are advised to shift focus towards large-cap where valuations are comparatively comfortable’’, Khemka said.

However, the broader markets were the worst hit with the S&P BSE midcap index falling 2.50 per cent and its small cap index crashing by 4.18 per cent. The bearish sentiment even engulfed some of the private sector banks which has reported decent numbers.

While ICICI Bank declined 0.29 per cent to end at Rs 929.75, Kotak Mahindra Bank which also announced the appointment of a new CEO fell 1.67 per cent.

Markets will remain closed on Tuesday on account of Dussehra festival.