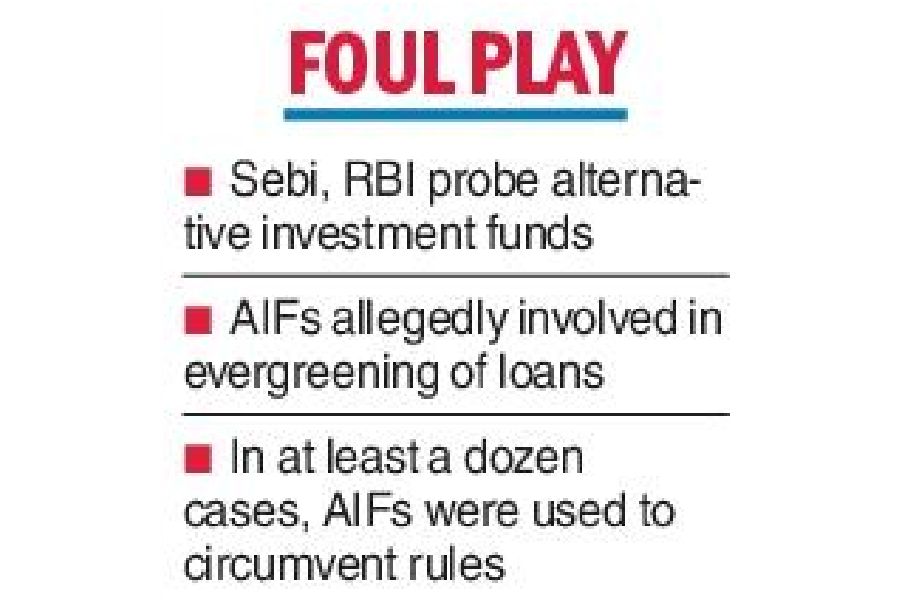

The Securities and Exchange Board of India (Sebi) and the Reserve Bank of India (RBI) are reportedly probing close to a dozen cases of alternate investment funds (AIFs) allegedly being used to bypass regulations and this includes “evergreening” of stressed loans.

A Reuters report said that the market regulator has found at least a dozen cases involving Rs 15000-20000 crore where AIFs have been misused to circumvent the rules of other financial regulators.

It added that the cases that are being investigated comprise instances of non-bank finance companies (NBFCs) selling stressed loans to AIFs with the fresh funds being used to repay the original debt.

Known as evergreening, this practice is adopted to keep bad or stressed loans under control

In May, RBI governor Shaktikanta Das said the central bank found several instances of lenders trying to hide the true state of bad loans in their books.

``During our supervisory process, certain instances of using innovative ways to conceal the real status of stressed loans have come to our notice,” Das said.

If the AIFs are found to be complicit, they could be penalised and restrictions imposed on them.

Sebi is also looking at whether some AIFs have been used to bypass caps on foreign investment in certain sectors.