The Securities and Exchange Board of India (Sebi) cancelled the certificate of registration of Brickwork Ratings India (BWR) and directed the credit rating agency (CRA) to wind down its operations within six months.

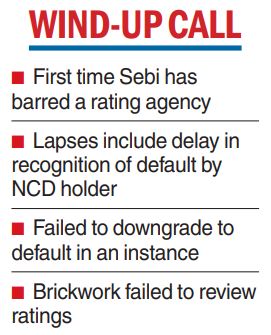

This is the first time that the market regulator is terminating the licence of a CRA. Sebi also barred BWR which is promoted by Canara Bank from taking any new clients or fresh mandates.

The regulator said BWR failed to exercise proper skill, care and diligence while discharging its duties as CRA, which has defeated the very purpose of regulations such as investor protection and orderly development of the securities markets.

“The repeated lapses, noticed across multiple inspections conducted by Sebi, shows that governance changes recommended in earlier inspections, and monetary penalties imposed have not proved effective or deterred the notice (BWR) in addressing very basic requirements of running a CRA. Strict regulatory action, in my considered view, is required at this juncture to address the issue and protect the market ecosystem,’’ the 51- page order said.

Sebi had carried out the inspections of Brickwork for the periods April 1, 2014 —September 30, 2015 and April 1, 2017 —September 30, 2018. The contraventions and deficiencies observed in these inspections led to initiation of separate adjudication proceedings against CRA.

While a monetary penalty of Rs 3 lakh was imposed after the first inspection, a fine of Rs 1 crore was fixed after the second inspection for violations involving lack of surveillance mechanism for tracking the interest or principle repayment schedule of issuers or other material events that may impact the creditworthiness of the issuer.

The regulator came across various lapses in these inspections. These included a delay in recognition of default of NCDs of Bhushan Steel even after the disclosure of default by the Debenture Trustee (DT).

BWR failed to downgrade to default the rating for the NCDs of Gayatri Projects.