The board of Securities and Exchange Board of India (Sebi) is likely to consider key proposals in its last board meeting of 2022 on Tuesday. These include major changes in share buyback, tighter disclosure for listed firms and strengthening governance at market infrastructure institutions such as stock exchanges.

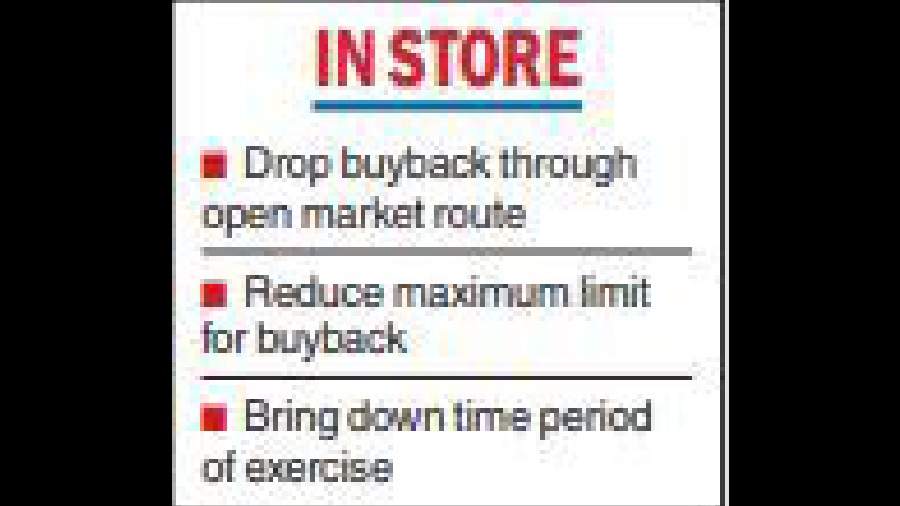

In November, the market regulator had released a consultation paper on the review of the buyback regulations which were first notified in November 1998. A key proposal before the Sebi board is to drop buyback through the open market route in a phased manner.

A sub-group headed by Keki Mistry, vice-chairman & CEO, HDFC, had recommended this method be closed from April 2025. Currently, companies repurchase their shares either through the tender offer or the open market method.

Recently, One 97 Communications, the Paytm parent, had announced a share buyback at a price of up to Rs 810 per share. Though this is at a premium to the current market price, investors were left disappointed as the company did not choose the tender offer route. Paytm has said in a regulatory filing that it will commence the share buyback on Wednesday.

The Sebi board will also consider a proposal to reduce the maximum limit and time period for a buyback. Currently, companies are allowed to buy back less than 15 per cent of a firm’s paid-up capital and free reserves.

Companies are now allowed to close the buyback offer within six months.

The panel has suggested the time period be reduced to 66 working days with effect from April 1, 2023 to 22 working days from April 1, 2024. It also recommended the 15 per cent maximum limit be brought down to nil from April 1, 2025.

The sub-group which felt that the system of taxing buybacks in the hands of companies unfairly burdens shareholders that choose not to tender their shares had suggested taxing only those who opt for the plan.

The Sebi board on Tuesday could also tighten disclosure rules for listed companies: they will have to announce any material event in 12 hours down from 24 hours.