Retail investors holding physical securities no longer run the risk of a freeze on their folios if they do not furnish PAN and Know Your Customer (KYC) details.

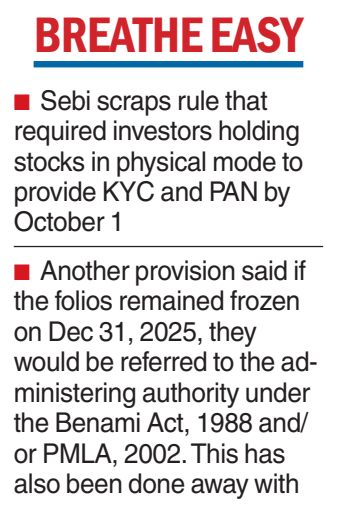

The Securities and Exchange Board of India said on Friday that it had decided to scrap the onerous rule that required such investors to provide these details by October 1, failing which their folios would be frozen.

The market regulator also did away with another provision which said that if the folios continue to remain frozen on December 31, 2025, they would be referred by the registrar and transfer agent (RTA) or the listed company to the administering authority under the Benami Transactions (Prohibitions) Act, 1988 and/or Prevention of Money Laundering Act, 2002.

In a circular issued on Friday, the market regulator said it had been decided to do with these provisions based on the feedback from the Registrars’ Association of India and feedback from investors.

“Investors will now be able to receive dividend/interest payments and get their grievances redressed,” said Makarand M. Joshi, founder MMJC & Associates, a corporate compliance firm.

However, Joshi added that the market regulator has issued circulars mandating holdings in demat form to avail the benefits of bonus issues, rights issues and stock splits. Therefore, investors need to make a considered decision whether to keep holdings in demat or in physical form.

In a circular issued on March 16, 2023, Sebi had said that it would be mandatory for all holders of physical securities in listed companies to furnish PAN, nomination, contact details, bank account details and specimen signature for their corresponding folio numbers. It had said that if any one of these document or details were not available on or after October 1, 2023, the folios would be frozen by the RTA.

It had further pointed out that the security holder whose folio have been frozen shall be eligible to lodge grievance or avail any service request from the RTA only after furnishing the complete documents or details. They will also be eligible for any payment including dividend, interest or redemption payment of the particular folios only through electronic mode with effect from April 1, 2024.

However, RTAs and companies continue to face hurdles when it comes to implementation of the rules.

“There have been numerous instances where the companies have approached investors but the response has been abysmal. Either the addresses are wrong or the investor has not responded at all,” B. Narasimhan, a veteran practising company secretary and former chairperson of the Registrars’ Association of India, told The Telegraph.

There are also instances where many genuine investors have lost track of their folio details for investments made years ago, and also failed to designate a nominee for their shares, leaving legal heirs in the dark and the shares unclaimed.

He added that while Sebi has taken the right step in the near term, there is a need to address the challenge in the long term as companies are incurring expenses in running after shareholders with physical shares who are not responding or, in some cases, are non-existent.

“In the modern era where everything is electronic, the shareholders should at least respond and give the requisite details in order to prevent fraud,” he said.