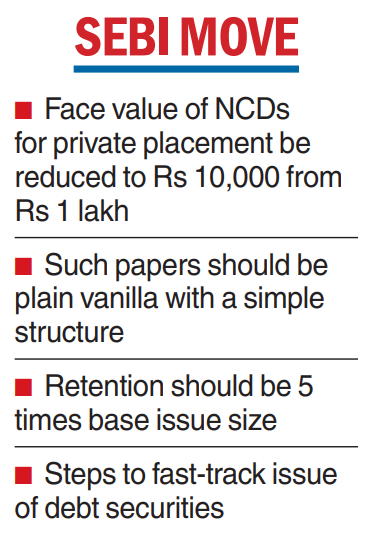

The Securities and Exchange Board of India (Sebi) is looking to introduce the concept of “fast track” public issuance for debt securities and further reduce the face value of debt securities, including non-convertible debentures, issued on a private placement basis to Rs 10,000 from Rs 1 lakh at present.

“The main intention of a fast track public issuance of debt securities is to facilitate frequent issuers with a consistent track record, to make public issues of debt securities with reduced time, cost and effort,” Sebi said in its consultation paper.

To further enhance the participation of the non-institutional investors in the corporate bond market, Sebi has “proposed to permit issuers to launch NCDs (non-convertible debentures) or NCRPS (non-convertible redeemable preference shares) with the face value of Rs 10,000”.

However, in such cases, the issuer should appoint a merchant banker who would carry out due diligence for issuance of such privately placed NCDs and NCRPS and disclosure requirements in the private placement memorandum, Sebi said.

Further, such debt securities should be plain vanilla with a simple structure and should not have any credit enhancements or structured obligations, it added.

Further, the regulator has suggested the requirement of appointment of a merchant banker in case of issuance of Securitised Debt Instruments (SDIs) at a face value of Rs 10,000.

Sebi suggested that instead of inserting the audited financials for the last three financial years and Stub period financials in the offer document, the same should be allowed to be provided as a QR code scanning which opens the web link to the financials on the issuer’s website.

Further, details of certain information required for the current year such as Related Party Transactions (RPTs), and remuneration of directors among others to be specified as required up to the latest quarter. Also, Sebi has suggested that record dates should be standardised 15 days before the due date of payment of interest or redemption.

It proposed the timeline for listing fast-track public issues of debt securities should be T+3 as opposed to T+6 for a regular public issue.

The issuers opting for the route should be allowed to utilise the electronic modes to advertise the public issue and the requirement of advertising in newspapers should be done away with.

Such issues should be kept open for a minimum of one working day and a maximum of 10 working days.

Further, the retention limit should be fixed at a maximum of five times of base issue size to provide more flexibility to the issuers in terms of fundraising.

Sebi has sought comments from the public till December 30.