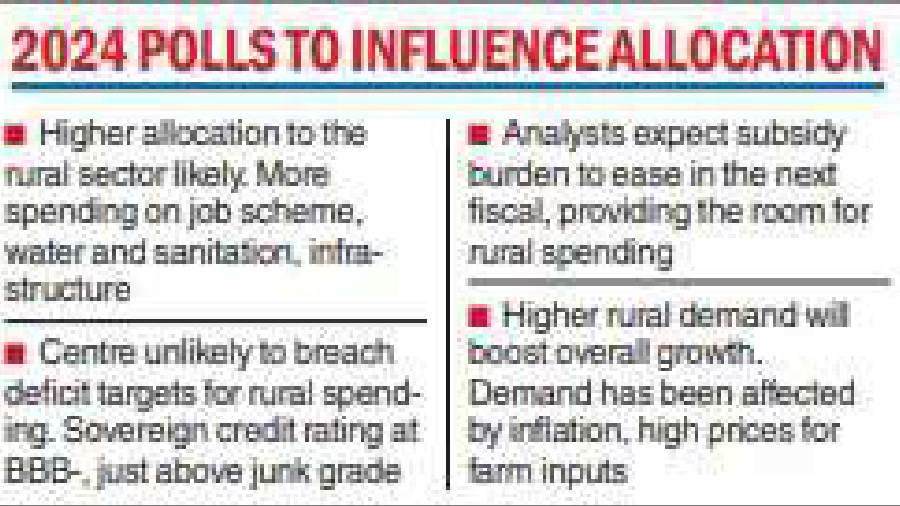

The last full budget of the Modi government before the general election in 2024 is expected to allocate a greater sum for rural spending — on the job scheme, water, sanitation and housing, and infrastructure — which will improve rural employment, incomes and demand.

With limited fiscal space, it is unlikely finance minister Nirmala Sitharaman will go for all-out tax incentives; instead, the budget may focus on welfare spending measures.

The budget allocation over the last decade shows that funding for rural job scheme MNREGA has been increasing consistently since FY16 (2015- 16).

The increase was the sharpest at 55 per cent between FY20 and FY21, with an allocation of Rs 1.11 lakh owing to the pandemic.

In FY22, the allocation was down to Rs 98,000 crore and Rs 73,000 crore in FY23. However, the Centre has recently sought supplementary grants worth Rs 45,174 crore for the scheme, that makes the allocation on par with the disbursements during the pandemic year.

“We believe the current year budget will have renewed focus on rural development and credit availability — MNREGA, PM Awas, food security — some tax sops for the middle class, renewed thrust on infrastructure development, some concrete steps on energy transition and higher education,” Amnish Aggarwal, head of research, Prabhudas Lilladher, said.

Madan Sabnavis, chief economist at Bank of Baroda, said the allocation for the MNREGA for FY 24 could be close to the sum budgeted for in FY23. “Under any normal circumstance, the government would stick to its Budget in FY23. However, there are chances of an increase, if there’s adversity in the rural economy,” he said.

UBS India economist Tanvee Gupta Jain said “the upcoming budget is likely to boost rural/agri spending by $10 billion — a growth of 15 per cent over FY23 — and maintain double-digit 20 per cent growth in public capex over the current fiscal, given that the nation will be going to the polls in mid-2024”.

However, the government is unlikely to go beyond fiscal boundaries with its election-oriented budget, she said.

Jain expects the subsidy burden to ease significantly in FY24 creating more fiscal space to reallocate money towards existing rural schemes.

“The central government’s subsidy burden to ease significantly in FY24, creating fiscal space to reallocate money towards existing rural schemes including the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) 2005, rural housing and roads amongst others.”

Analysts said rural demand is a key trigger for overall growth as rural India comprises 65 per cent of the population but accounts for just 30 per cent of consumption spends in the economy.

Rural sentiment has been impacted by high inflation, high prices of farm inputs such as diesel and fertiliser and uncertain environment.

The Centre has made it clear that despite external shocks and global uncertainties it intends to meet the fiscal deficit target of 4.5 per cent of GDP by the end of the 2025-26.

Efforts to maintain fiscal discipline reflect concern over India’s sovereign credit rating, currently at BBB-, just a notch above junk status.