The rupee on Friday tumbled below the 82-mark and closed at a record low of 82.33 against the dollar as hawkish statements continued to pour in from US Federal Reserve members calling for more interest rate hikes to tackle inflation.

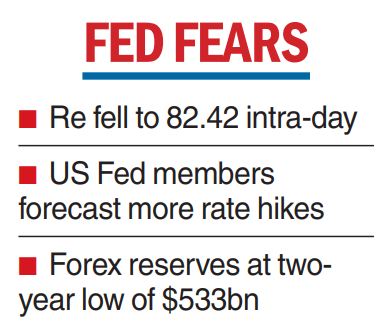

A firm American currency also weighed on the domestic unit which crashed to an historic intra-day low of 82.42 against the dollar.

The Dollar Index which measures the greenback’s strength against six currencies was trading close to 113 levels, while crude oil prices ruled firm as it traded at over $96 per barrel against the previous close of 94.42.With the US economy adding 263,000 jobs against expectation of 250,000 in September and the unemployment rate coming lower at 3.5 per cent, the Fed can continue with its aggressive action by raising interest rates again early next month by at least 75 basis points.

On Thursday, new Federal Reserve governor Lisa Cook reportedly said that US inflation remained stubbornly high. The inflationary pressure is broad-based and that the central bank will continue to tackle rising prices till the job is done. Over the past few days, other members have also shared a similar sentiment.

Analysts said the rupee would continue to be under pressure and RBI intervention would hold the key.

It was not immediately clear if the central bank intervened in the markets on Friday.

Meanwhile, numbers released by the RBI showed forex reserves have declined to over a two-year low of $532.66 billion as on September 30.