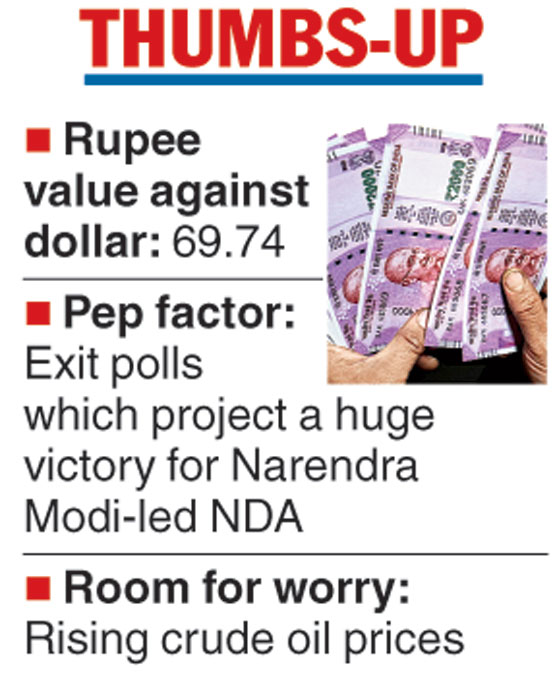

The rupee on Monday appreciated by 49 paise, the biggest single-day gain in two months, to close at 69.74 against the dollar following sharp gains in equities and forex inflows after exit polls suggested another term for the ruling NDA government.

Forex traders said investors welcomed exit poll results that predicted a thumping majority for the current BJP-led government.

At the interbank foreign exchange, the domestic unit opened at 70.36 and advanced to a high of 69.44 during the day. The currency finally settled at a nearly two-week high of 69.74, a rise of 49 paise or 0.70 per cent against the dollar over its previous close. On Friday, the rupee had settled at 70.23 against the dollar.

This is the biggest single-day gain for the rupee since March 18 when it had zoomed 57 paise, or 0.82 per cent.

According to WGC Wealth chief investment officer Rajesh Cheruvu, India saw a remarkable strengthening in its currency after the exit polls and some de-coupling of the rupee from other emerging currencies could be seen over the next few trading sessions.

Sentiments were also buoyed by a positive opening in domestic equities and foreign fund inflows.

The benchmark Sensex zoomed over 1,422 points and the NSE Nifty surged 421 points after most exit polls showed that the Narendra Modi-led NDA is returning to power with a huge majority in the Lok Sabha elections.

The 30-share index ended 1,421.90 points, or 3.75 per cent, higher at 39352.67. During the day, the gauge hit a high of 39412.56 and a low of 38570.04.

The broader NSE Nifty soared 421.10 points, or 3.69 per cent, to 11828.25.

“Most of the exit polls have projected a thumping majority for the NDA government. The government has taken bold steps in the last five years. This ensures policy continuity and required stability. Hence, it will attract long-term investors. So, if the exit polls match the actual outcome, then the rupee may head towards 68 levels in coming sessions,” said Rushabh Maru, research analyst-currency and commodity, Anand Rathi Shares and Stock Brokers.

However, rising crude prices weighed on the rupee. Brent crude was trading at 72.51 per barrel higher by 0.42 per cent.

The Telegraph