The rally in equities failed to lift the rupee on Monday, which closed below the 72-mark to the dollar for the first time in nine months as the greenback raced against other units.

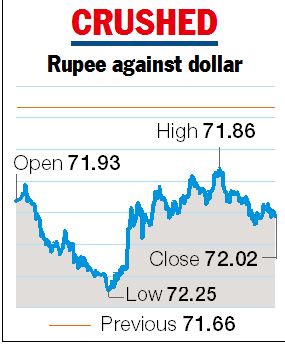

The domestic currency settled down 36 paise at 72.02 to the dollar, the lowest closing level since November 14, 2018, even as the benchmark index spurted almost 800 points on measures announced by the government last Friday.

Provisional data from the stock exchanges showed foreign portfolio investors (FPIs) to be net sellers worth Rs 753 crore. The rupee opened weak at 72.03 and hit the day’s low of 72.25 to the greenback as the trade war between the US and China worsened with President Donald Trump announcing tariff hikes on Chinese imports.

One of the factors that brought the rupee under pressure was the strong dollar against other currencies such as the Turkish lira, the Chinese yuan and the Australian dollar. Global currencies were in the negative territory in overnight trade because of escalating tensions between the US and China over the weekend.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.31 per cent to 97.94 after the euro and the pound dropped.

However, reassuring comments by the two countries on Monday that they are willing to resolve issues through negotiations helped the currencies pare their losses. Crude oil prices also rose with the benchmark Brent crude gaining 0.64 per cent to $59.72 per barrel.

Chinese vice-premier Liu He said his country was willing to resolve the trade dispute with the US through “calm” negotiations. US President Donald Trump said the US and Chinese trade negotiators would “very shortly” resume talks.

Experts pointed out that while the rupee’s movement would be driven by news on the US-China front, any change in FPI flows following the measures announced by the government could come to the Indian currency’s rescue.