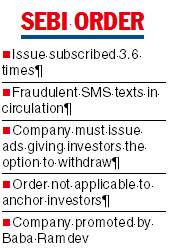

Investors to the follow-on public offering of Ruchi Soya Industries can withdraw their bids — following the circulation of unsolicited SMS texts on the offer.

The Securities and Exchange Board of India (Sebi) on Monday directed Ruchi Soya Industries to give an option to all its investors barring the anchor book participants to withdraw their bids from the follow-on public offering (FPO) which closed Monday.

The market regulator said it has spotted “the circulation of unsolicited SMSs advertising the issue, prima-facie the contents of which appear to be misleading/fraudulent and not in consonance with SEBI (ICDR) Regulations, 2018’’.

The market regulator held a meeting with the representatives of the issue’s book running lead managers on Monday.

Ruchi Soya must issue newspaper ads cautioning investors on the circulation of the unsolicited SMS.

The advertisements have to be issued on March 29 and March 30.

All the investors or bidders (except anchor book participants) shall be given the option to withdraw their bids and that the window for such a withdrawal shall be available from March 28-30.

The procedure for such a withdrawal shall be informed to investors through the advertisements.

This is the first instance in recent times where the market regulator has asked the lead managers to issue such ads . It is not clear who sent these SMSs.

Ruchi Soya is backed by Baba Ramdev's Patanjali Ayurved Ltd.

The edible oil company has fixed a price band of Rs 615-650 per share for the FPO that sought to raise Rs 4300 crore.

It had mobilised Rs 1,290 crore from anchor investors last week. They were allotted 19.8 lakh equity shares at the upper price band of Rs 650 per share.

The edible oil company had had fixed a price band of Rs 615-650 per share for the FPO that sought to raise Rs 4,300 crore.

It had mobilised Rs 1,290 crore from anchor investors last week.

They were allotted 19,843,153 equity shares at the upper price band of Rs 650 per share.